Average True Range

Average True Range is a technical analysis indicator that works as a measure of volatility. It was introduced — along with many other technical analysis tools — by Welles Wilder in his book, “New Concepts in Technical Trading Systems.” As of now, ATR is one of the most commonly used technical analysis indicators that withstood the test of time and made its way into many trading platforms.

How does it work?

Though it may not seem like it the idea behind the indicator is simple. Currency exchange rates always fluctuate. High volatility is one the reasons millions of traders all over the world just love the Forex market. The higher the volatility, the higher is the number of potentially profitable deals. With volatility come trading opportunities. The direction of the future trend is, of course, important but knowing that the trend is just about to begin is already extremely helpful. More than that, for certain strategies it is not even necessary to know the exact direction of the trend if volatility is high enough. There are several ways to estimate market volatility and ATR is utilizing one of them.

To understand how ATR works it is necessary to take a look at the concept of the true range first. According to Wilder, the true range is the greatest of the following:

- Current High less the current Low,

- Current High less the previous Close,

- Current Low less the previous Close.

Absolute values are used for the last two bullets to ensure positive numbers.

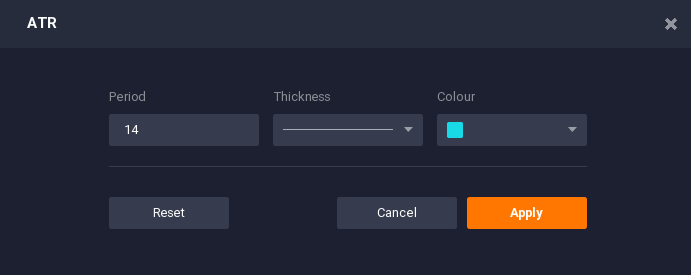

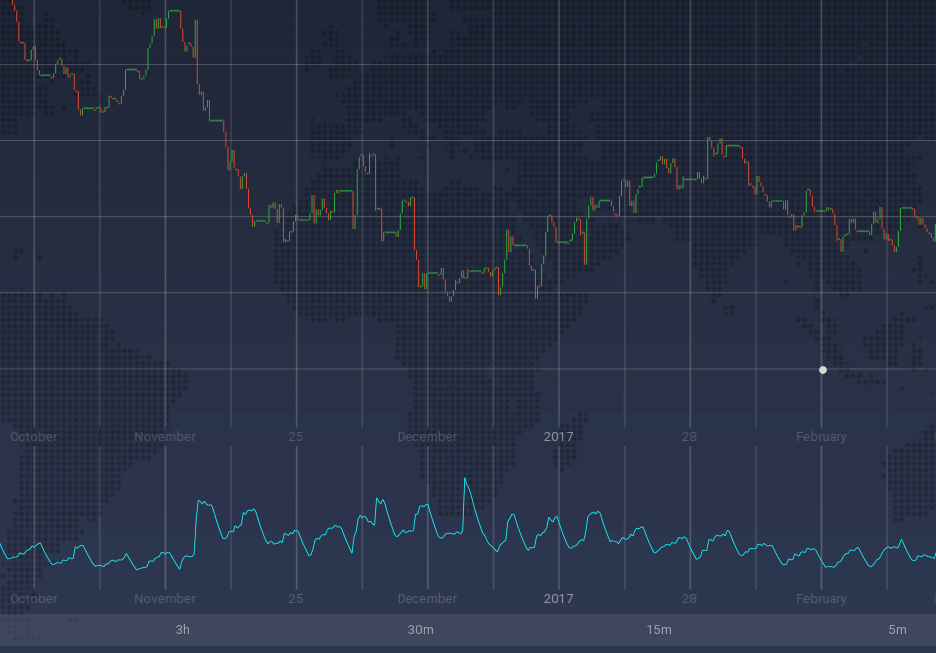

Average True Range is a moving average of the true ranges mentioned above. By default, a 14-period moving average is used. The whole indicator is represented by only one line. When volatility is on the rise, the ATR graph will go up. Alternatively, when the market is stable, the line will gravitate to the bottom.

How to set up?

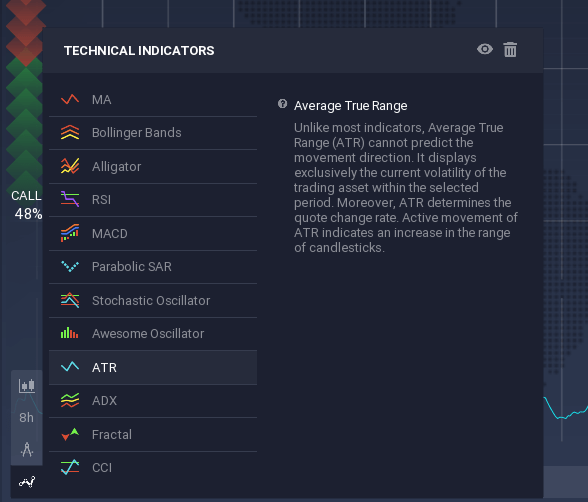

Setting up the ATR indicator in the IQ Option platform is easy.

Click on the “Indicators” button in the bottom left corner of the screen. Then choose ATR from the list of possible indicators.

Then click the “Apply” button. The indicator will appear in the bottom part of the screen, right below the price chart.

Average True Range is ready for use.

How to use in trading?

The indicator can be used by the investor to determine optimal entry and exit points.

Periods of low volatility usually intermingle with periods of high volatility, when the market is unstable, thus creating numerous trading opportunities. Everchanging nature of the Forex market is what makes it so tempting. Knowing when the period of low volatility (and therefore limited trading options) is about to end is a strategic advantage traders can be expected to use.

The longer the ATR period the more accurate the indicator will become, compromising a portion of trading signals instead. And vice versa, by shortening the number of periods it is possible to receive more signals but chances are some of them will be false or at least not as accurate as desired.

An important notice. ATR uses absolute values instead of a percentage change. Indicators of different companies and even the same company on different timeframes cannot be adequately compared with each other.

Conclusion

Average True Range is not an indicator that will demonstrate the future trend direction or provide complete information on how the price chart is expected to behave. Nevertheless, ATR is an indicator that is unique in its own way as it helps to track down volatility of the price action. Combined with trend-following and momentum-type technical analysis tools ATR can be a decent instrument with good potential.

NOTE: This article/material is not an investment advice.