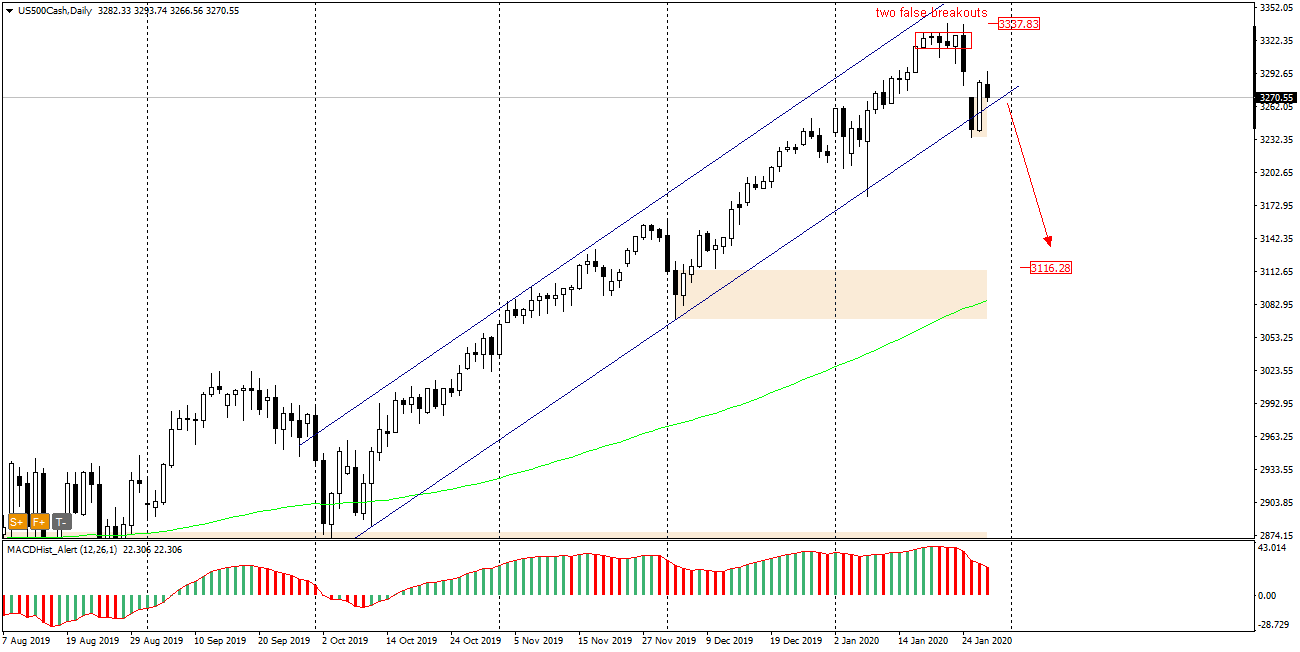

S&P500 – signal for declines

The S&P500 index, after many weeks of almost uninterrupted growth and the setting up successive ATHs, stopped at 3338. The daily candle of 17 January and another one formed an inside bar. The next few days were attempts to break it up and down, but at the end of the session the index always returned to the inside bar formation. It wasn’t until Friday, January 24th, that the breaking down proved effective and the index started moving south. Monday’s opening took place with a downward gap , which was closed…

Read More