Morning flat breakdown

Every night, quotes for almost all assets are included in the flat. Prices freeze in their corridor, not rising above or falling below a certain level. But as soon as a new day begins in Europe and large participants enter the market, the morning flat breaks down. The limits of the price corridor are crossed by quotations and the daily trend is set. This happens at approximately 5:00 to 7:00 UTC.

It is this pattern that is used in this strategy. All that remains is to learn to determine in what direction the breakdown will be. And it’s very simple!

We define the flat limits

It is best to do this with a timeframe from 1 min to 5 min, as we will analyze quite a large section of the graph.

Firstly, select the “Rectangle” tool in the “Tools” tab at the bottom of the page:

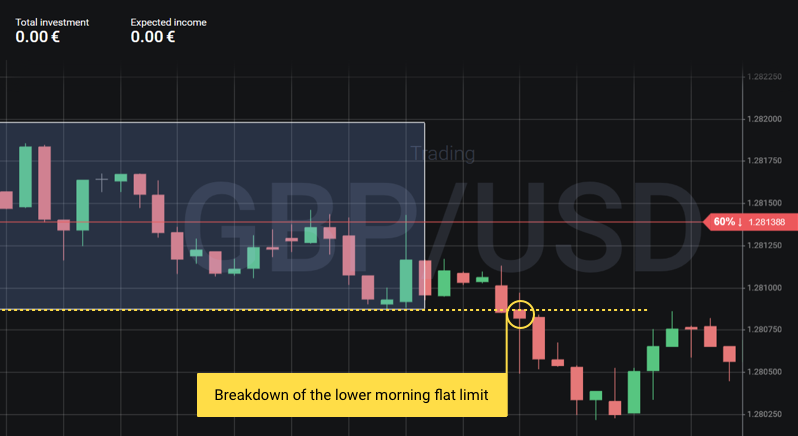

Using the rectangle, select the horizontal section of the graph from 5:00 to 7:00 UTC, and the vertical section between the minimum and maximum price in the indicated period:

The “box” obtained is the breakdown channel in which to trade.

How to make transactions

We recommend making transactions UPWARDS, when the candle has closed above the upper channel limit:

We recommend making transactions DOWNWARDS, when the candle has closed above the lower channel limit:

ATTENTION! For trading on the morning flat breakdown, only trending currency pairs are suitable, for example, EUR/USD, EUR/JPY, GBP/USD, GBP/JPY, and USD/JPY.

Expiration periods and risk management

Long expiration periods (greater than 15 minutes) are more suitable, as after the limit breakdown, short backing in the other direction is possible.

Use not more than 2-3% of your trading account balance for transactions!