Binary Options News Trading Strategy

When creating a news based strategy the ‘news’ that you trade will depend upon the asset that you are trading. Broad market moving news such as Gross Domestic Product (GDP), Consumer Confidence Index (CCI) and Trade Balance figures can have a significant impact on markets in general. These are key news items that drive the price of Indices and currency pairs up or down within seconds of release.

You could of course choose to trade more granular news events such as company reports or results on Stock options. This is great way to play the resulting moves that can happen if results over or undershoot prior analyst expectations.

Entry Signal

There are no real hard and fast rules that can be applied to trading the news with binary options. However there are many steps that you can take to help you build a strategy that will maximize your chance of success.

Trading the news requires pre-planning. Binary Options make this approach easier as you don’t have to work out where to place your stops or price targets as you would when Spot trading the markets. However you still need to identify your entry trigger and the direction that you expect the price to move.

A common way in which to trade news flow in binary options is by using a breakout trading strategy. The news is viewed as a potential trigger for the break.

There is actually a lot of flexibility as to how you can play such an approach. One of the simplest is to back the break from a prior range in the direction of the break. Once the initial break has been made you can either wait for some consolidation or ride the early momentum until the next expiry.

News Trading Example

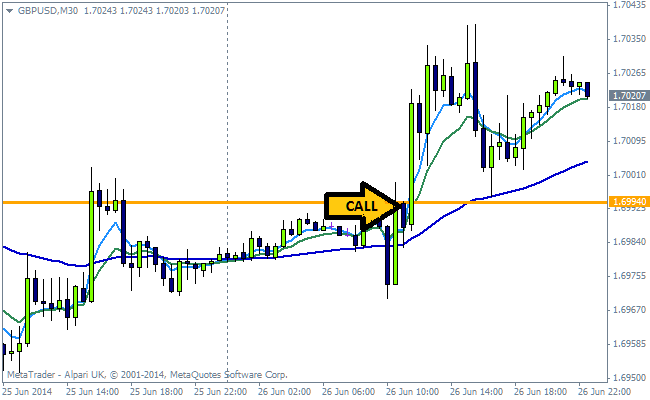

Here is an example of news trading in action. It is on the GBP/USD currency pair.

The market had tested and rejected the 1.70 level the previous day. However the price action retained a bullish bias. This was confirmed by a succession of higher highs and higher lows and rising moving averages.

The pair had also already tested support at 1.6994 earlier in the morning. With news due for release at 09:30 UK local time the bias was to send the pair higher through resistance level. Given the bullish momentum the trade was called higher to good effect.

Two Call trades were placed – an hourly contact and a contract to expire at the end of the day. Both came in for profit.

If the outlook had been less clear we could have traded the same news event using a ‘Boundary contract’. With this contract we can set up two separate price barriers to form an upper and lower range. This is a particularly good strategy to use on higher volatility news items where price action is likely to move sufficiently at the time of the news release to trip either the higher or lower barrier. In this scenario the ultimate direction of movement is less important as you are simply trading the volatility.

Points to Consider

There are a number of things to consider before jumping ahead with this strategy.

Creating a simple news based strategy for binary options requires a lot of pre-planning. You need to work through the trading process prior to the event. This will help you when news hits the markets as you will know exactly the course of action you are going to take.

You should work out the trigger level that you will use to enter the market, the contract that you are going to place and the expiry time that you are going to set.

You need to show trading discipline. As the work is carried out prior to the news event you should only ever be executing your orders. This means that you stick to your plan and avoid making any rash decisions in the heat of the moment.

Also depending on what news you are trading, you should also ensure that you don’t end up over exposing yourself.

If you are trading a major global news events such as the Non Farm Payrolls (NFP) always look to limit your total trading risk. Avoid pairs that may show a correlation in movement as a result of the news or data. Being overly exposed at these times can quickly cause you to compound your losses. It is therefore important to remain aware of the impact of volatility that surrounds such events.