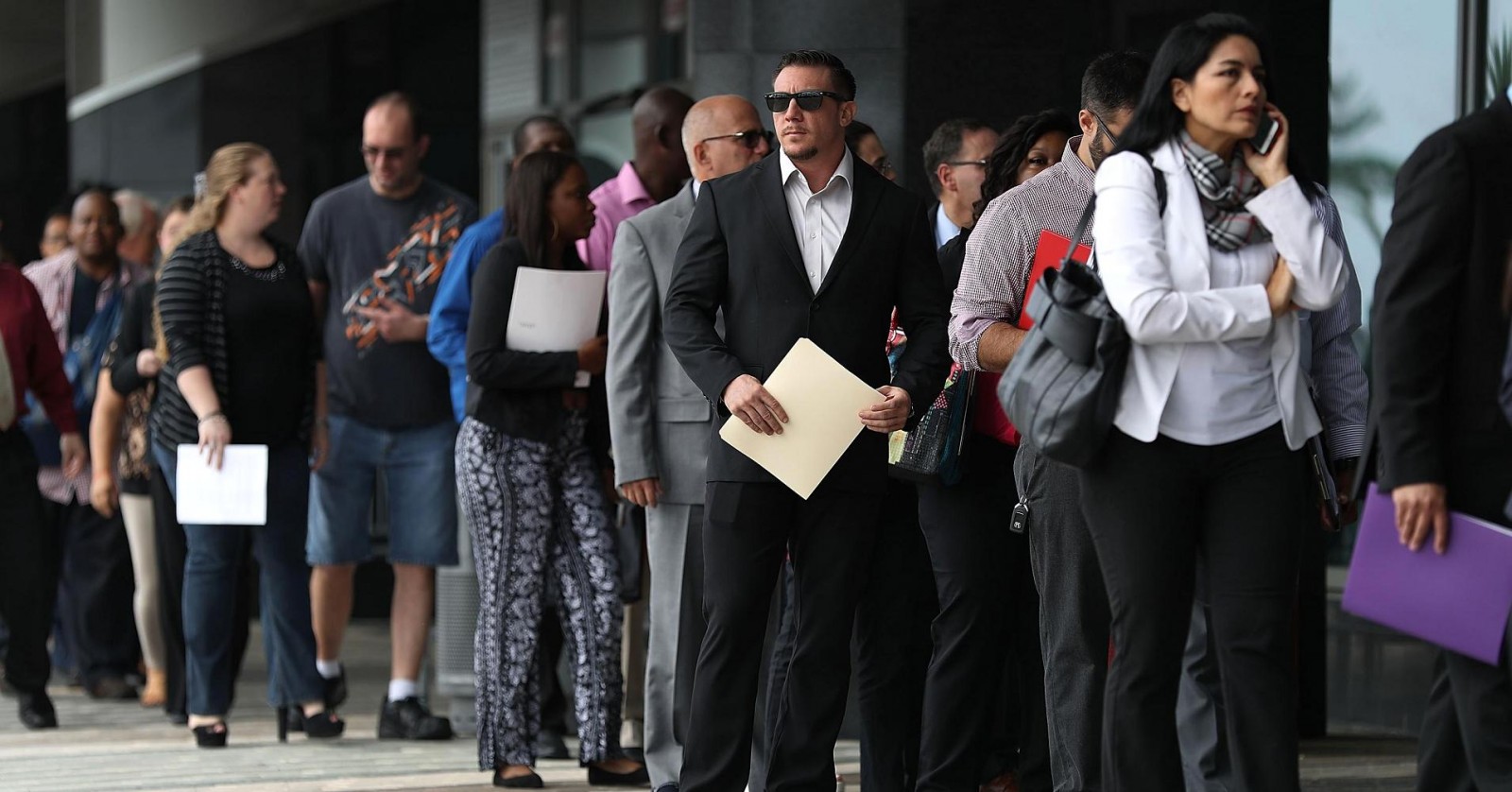

Non-Farm Payrolls (May 2017)

Considered one of the most important employment and economic strength indicators, nonfarm payrolls will be reported at the end of this week for May 2017. The US Bureau of Labor Statistics will release the monthly data on Friday 2nd June 2017 8:30 a.m. EDT as part of its monthly Employment Situation Report. The Non-farms figure specifically provides the change in the total number of nonfarm payrolls compared to the previous month – representing all jobs except those related to farm work, unincorporated self-employment, and employment by private households, the military…

Read More