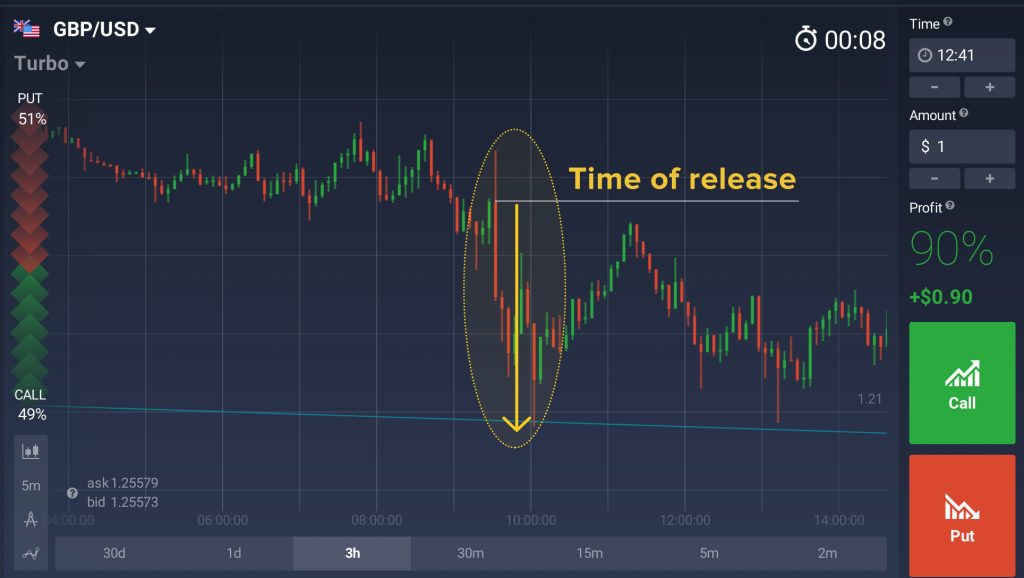

UK Manufacturing Production Data

The Great Britain Pound (GBP) gains strength against the US Dollar (USD), increasing the price of GBPUSD to more than 1.2500 ahead of Britain’s industrial production report which is scheduled for release on Friday. The technical bias has turned bullish after the emergence of bullish pin bar a couple of days ago. GBP/USD Technical Analysis As of this writing, the pair is being traded near 1.2513. A hurdle may be noted around 1.2675 (the trendline resistance area) ahead of 1.2700-1.2706 (the high of last major upside move & psychological number) and…

Read More