Discipline is a trader’s best friend

Discipline is a trader’s best friend. It is the most profitable tool a trader can use and by far the one least employed. Without it all other tools are meaningless, any trade you make is little more than a gamble and that’s not the way to ensure success.

What is discipline and why does it matter so much? According to the Merriam-Webster on line dictionary there are a few definitions associated with the word discipline that are important to traders. First and foremost, discipline is control gained by enforcing obedience and order. This means rules, traders who want to gain control of their trading, so they can avoid excess loss and maximize always have rules. Those who succeed in taking control of their trading always follow them.

Webster’s goes on to describe discipline as orderly or prescribed conduct or pattern of behavior. It is accepted that successful people follow certain patterns that guide them so success. Regarding trading this means once again rules to govern why and how trades are made. A newer trader, or one wishing to improve their results, could pattern their behavior against that of another, more successful trader to effect control of their success.

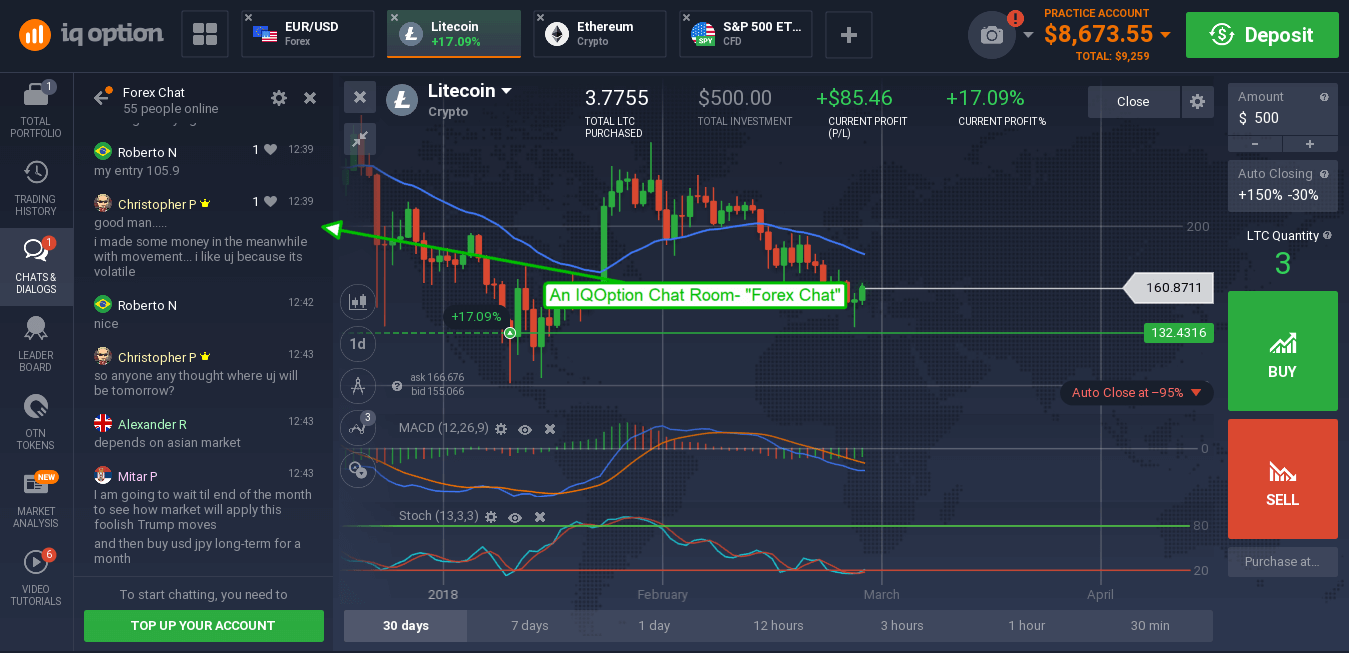

Discipline is also described as training, training that is intended to shape, mold or perfect the mental faculties or moral character. This ties right back into having trading rules and modeling behavior after other traders, and then takes it to the next level. Training, mentoring, from another trader is a great way to gain control of your trading. It’s easy to read a book but harder to follow on through, to have the discipline to make yourself do it. A mentor can help with that… so long as their motives are in the right place. There are a lot of frauds in the financial world, all looking to help traders in need, so be careful when looking for a mentor. IQ Option’s Chat Room is one place to find trading peers for strategy, theory and advice.

Use discipline to take control of your profits

Here is a quick look at a few of the areas in which discipline will help you take control of your profits. Remember, you make trading rules to protect yourself, to protect your capital and allow to keep trading day after day, regardless of the wins and losses you make. You make the rules, so you won’t have to make tough decisions at bad times, when prices are moving against you, it is best to trust them.

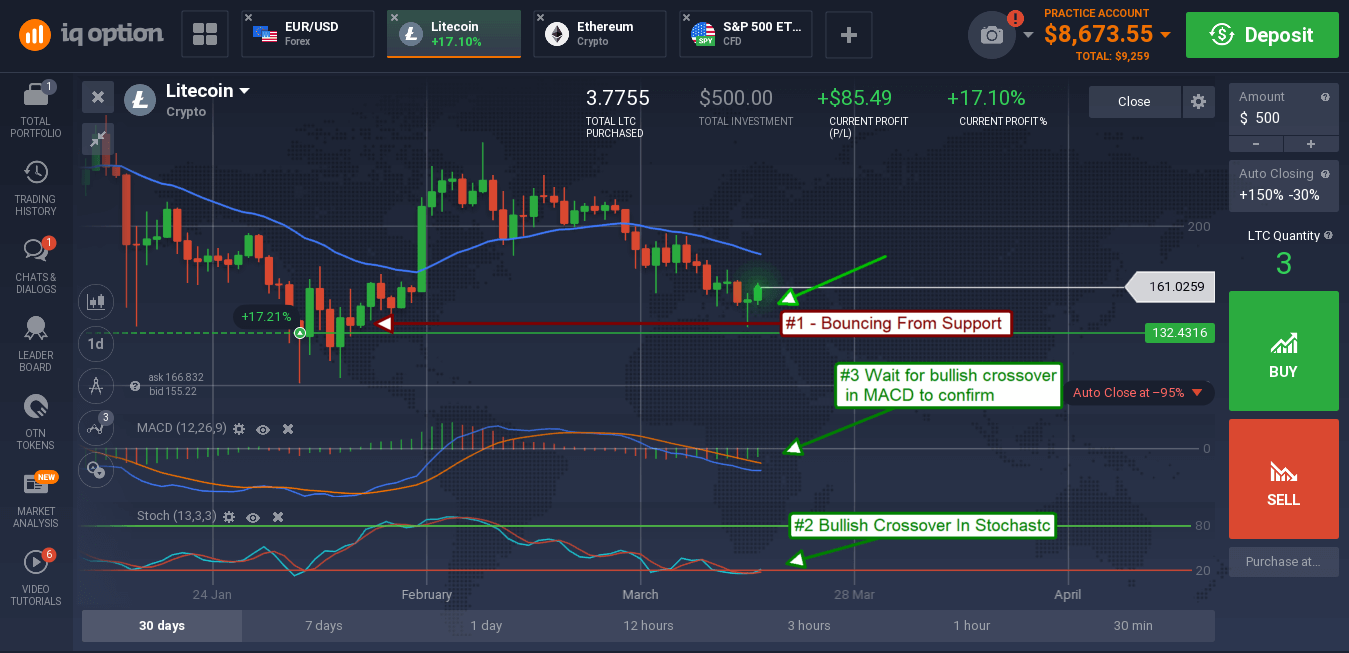

Entry Points/Trading Signals

Trading signals are the rules that tell you when to trade. They should include things like moving averages, support & resistance, technical indicators and other tools of the traders art. The reason for these rules is to weed out bad and lower probability signals from better and higher probability signals.

If you don’t follow your rules there is no point in making them. If you aren’t going to wait for good signals, if you don’t have the patience, you may as well play the slots where you can make a “trade” any old time you want.

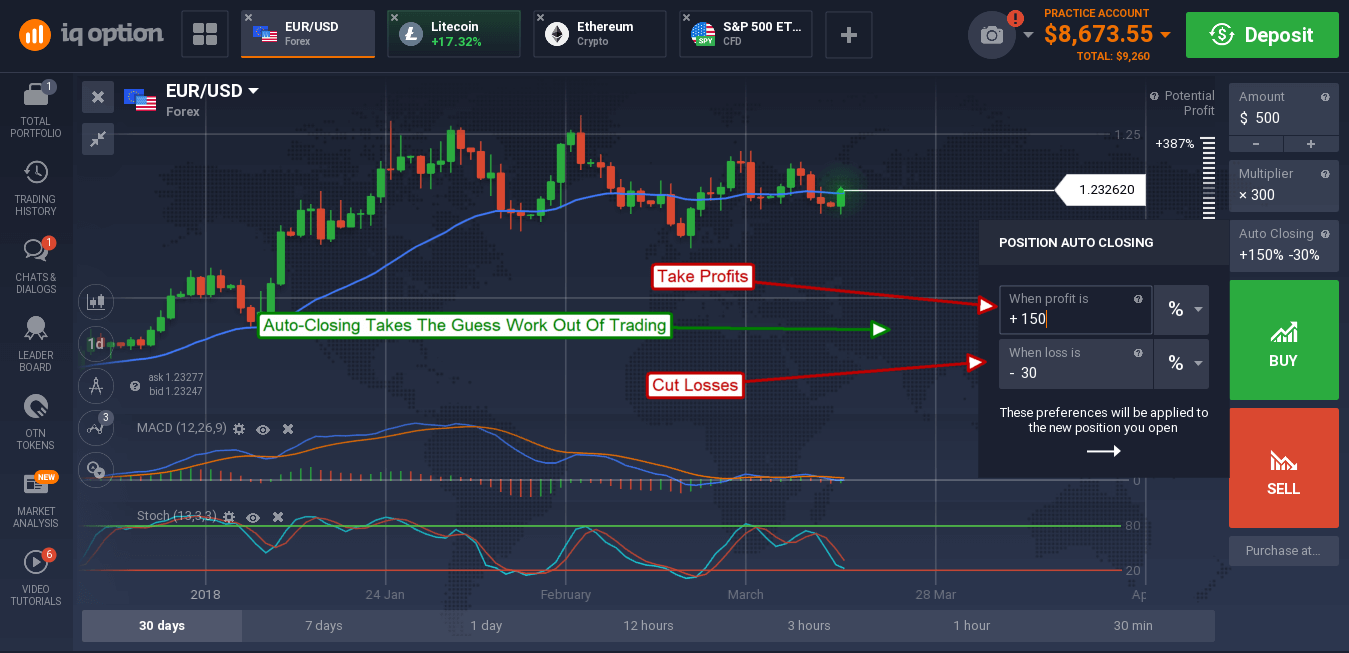

Cutting Losses

Cutting losses, stopping your losses, is very important. You never want to risk too much on any one trade and never lose more than your account can sustain. It’s hard to close a trade when it goes against you, no one wants to admit failure or take a loss, but it’s better to take a small loss than a big one. One of my biggest mistakes, one that I have made repeatedly, is letting my losers run when I should have nipped the loss in the bud.

Take Profits

Taking profits is another mistake I have made repeatedly, to the detriment of my account. The mistake I make is NOT taking them when I see them. If a trade is making money, especially if price movement in the underlying asset is halted by support or resistance targets, take the money off the table.

There is no reason to gamble known winnings for a chance of winning a little more when there is a risk you could lose the winnings, and the entire trade. If you think losing on a bad trade will suck wait until you lose a trade that was once a winner.