Diversification of trading risks.

Surely, each of you has been faced with the fact that one and the same trading system sometimes works quite differently at different times and on different days of the week. Often, it is not a matter of the effectiveness of the strategy itself, but of changes in the dynamics of quote movement on the market of the trading asset. How can you make a profit, regardless of this? Trade “portfolios” – diversify the risks of losses on one asset with profits on another!

What is risk diversification?

Risk diversification is when the trader creates conditions that make it possible to cover potential losses on certain trading tools with additional profits on others.

Here is an example. Imagine that you are trading on the “Trade in the channel” strategy, using only the AUD/CAD currency pair. After the publication of macroeconomic news, that pair leaves the channel boundaries, and begins to intensively to move upwards, and you start to get losses from concluding transactions on prices rebounding inside from the boundary. Yes, the market will calm down soon enough, and your transactions will continue to close with gains. But this could take some time, during which you won’t know how many more transactions will close at a loss.

Now, imagine that you are using several pairs at the same time: NZD/USD, AUD/CAD, GBP/USD, and USD/CAD. Even if you don’t trade the AUD/CAD pair with gains, the profits you make on the NZD/USD, GBP/USD, and USD/CAD pairs will easily “pull” your trading portfolio back into the black. This is called diversification of trading risks.

Rules for compiling diversified trading portfolios

The difference in the dynamics of quoting assets.

One of the main conditions of diversification is the difference in quoting assets used to compile the portfolio. In other words, it’s the idea that extreme changes in the movement of one asset quote do not affect the dynamics of the movement of other quotes.

If you use currency pairs for trading, it is necessary to choose different currencies, for example: EUR/USD, GBP/JPY, USD/CHF, and AUD/CAD. Let’s say the euro rapidly becomes cheaper against other market currencies, then all the pairs in which the EUR is the numerator will move down at the same time, for example: EUR/USD, EUR/JPY and EUR/GBP. And if you’ve included all of these pairs in your trading portfolio, you will start to see losses from all three of those currency pairs.

With regard to assets of the commodity and stock markets, they are not usually interconnected, and the dynamics of their quoting is completely different.

No more than 5 trading tools.

As practice shows, it is impossible to embrace the infinite, and the trader will not physically be able to cope with a trading portfolio comprised of more than 5 tools.

The nature of price movement.

As you have probably noticed, each trading tool has its own characteristics of price movement. For example, all currency pairs that include the Swiss franc (CHF), the Australian dollar (AUD), and the New Zealand dollar (NZD) almost always move in the flat channel. The currency pairs where those currencies are listed (for example, NZD/USD, AUD/CAD, USD/CHF, etc.) are best used in diversified portfolios for trading in the channel.

So the euro (EUR), Japanese yen (JPY), and the British pound sterling (GBP) are trending currencies, and currency pairs with them (for example, EUR/USD, USD/JPY, GBP/USD, etc.) almost always move in the trend. Therefore, they are best used for trading on trend strategies.

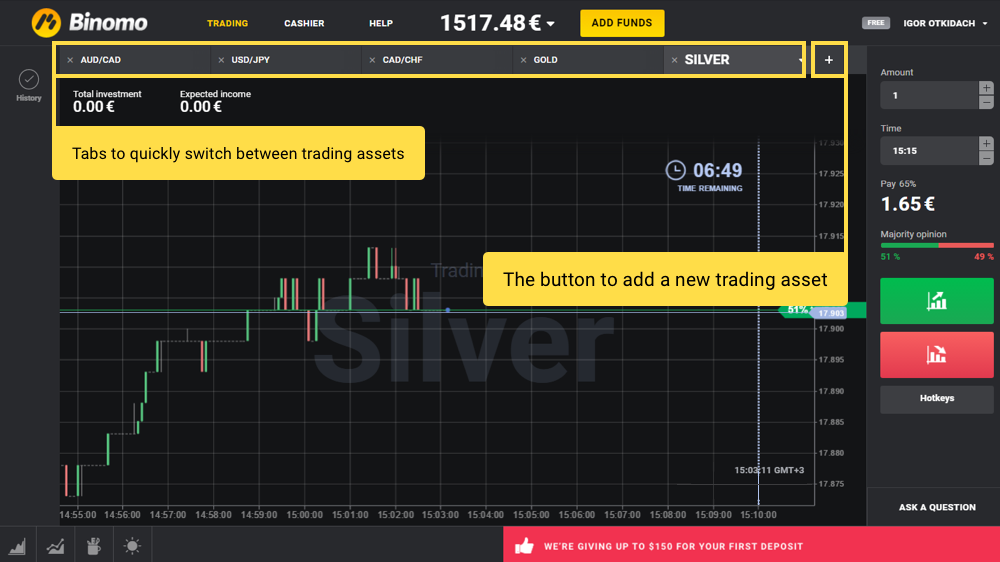

And here’s another useful tip for those who decide to diversify risk through portfolio trading. The Binomo trading platform features special tabs that you can use to quickly switch between the selected assets in your portfolio. This will allow you to effectively monitor the situation on the markets of those selected assets and quickly respond to changes!