How to create Orders Even When the Market Is Closed

With the introduction of a new feature “”, IQ Option traders now have an opportunity to open deals (both Buy and Sell) at the opening price of the asset. This feature is obviously meant to be used when working with Forex and CFDs (contracts for difference) due to the fact that these two instruments are not traded 24/7 and have periods of inactivity. But why would you want to use this new feature and, more importantly, how to get the max out of this seemingly minor change to the platform? Read the full article to know more.

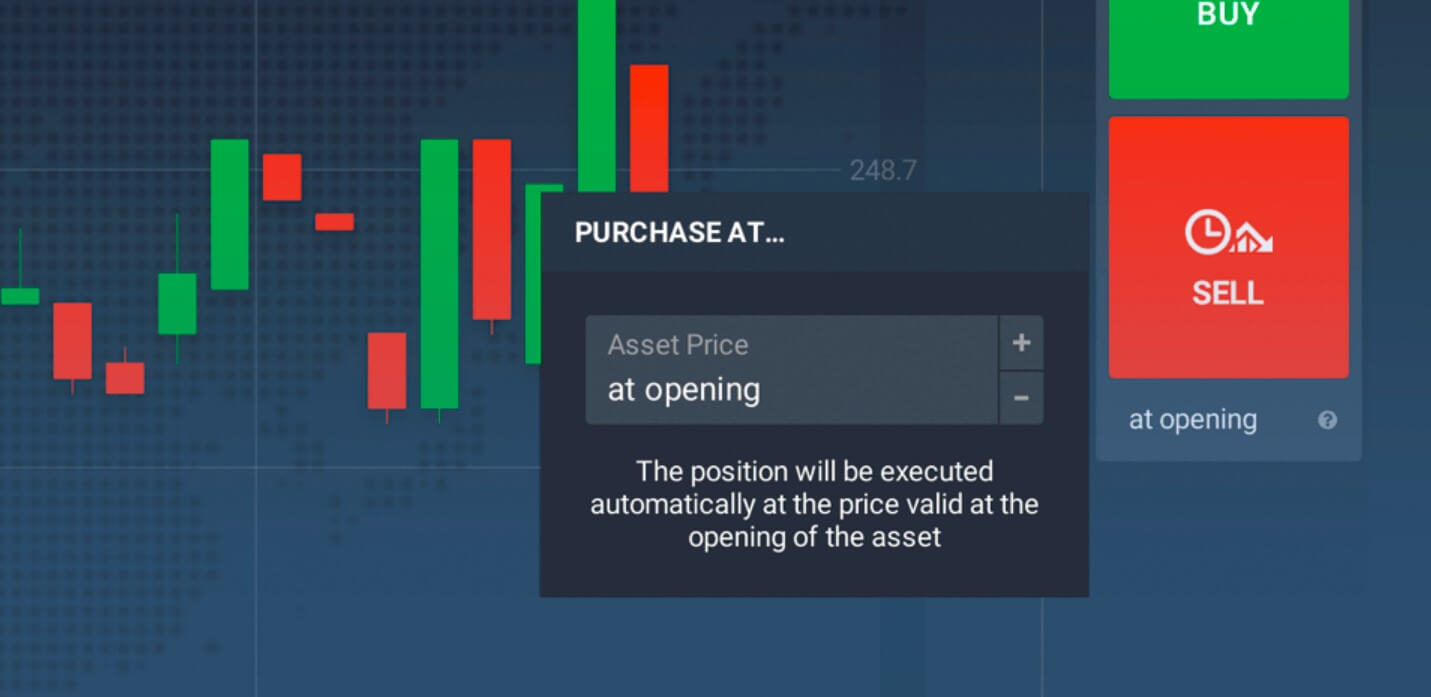

Before the introduction of “Market-on-open Orders” feature, traders had only one option to submit a pending order. By filling in the “Purchase at…” box at the bottom right-hand corner of the trade room, you could specify the price at which you were ready to buy or sell the asset. This option can also be of great help. For example, when expecting an asset price to rebound after a sudden drop, the trader could set the purchase price at a lower level than currently observed on the market. If the forecast holds true, the ensuing positive trend will creative a trading opportunity.

Not being traded during the weekends (Forex) or traded during the American business hours only (CFDs), these instruments can open at a noticeably different price. The discrepancy can not only be predicted but also used to gain leverage against the market. This feature should be applied differently to Forex and CFDs due to fundamental differences in the way they are traded.

Contracts for difference are an equity-based instrument. Therefore, there is always a particular company behind them. You would want to follow the financial performance of the said company in order to trade CFDs successfully. Every publicly traded company reveals key financial data four times per year, before or after the market closure. The following trading session usually starts with a sudden increase or decrease in the share price (depending on the information provided in the report).

With a high number of assets available in the CFD section of the IQ Option trading platform, suchlike opportunities arise weekly.

Forex, on the other hand, is a market that works 24/5. Therefore, there is only one opportunity (for each asset) to submit a market-on-open order per week. As long as there are no major announcements made by the national financial authorities (Federal Reserve, Bank of England, Bank of Japan etc.) on weekends, only sudden political and macroeconomic events have the potential to affect the exchange rate of national currencies. Keep that in mind when trading currency pairs.

All in all, market-on-open orders, if used correctly, can yield impressive results. This feature, however, is hard to master, as it is relatively easy to predict the direction of the price at the moment of market openings, but not always easy to tell which direction it will follow afterwards.