How to trade on price momentum?

Do you like new, untraditional, profitable solutions? If yes, you’ve got to learn the Awesome+ strategy. It’s very easy to understand and it works perfectly on average and highly volatile markets with highly liquid assets; in other words, it loves mobility and popularity. It really doesn’t matter when you use it, the main thing is that the market should be “breathing”.

Template setup

Assets to trade:

AUD/USD; EUR/USD; EUR/GBP; GBP/USD with levels +/- 0.0005

AUD/JPY; EUR/JPY; USD/JPY with levels +/- 0.03

GBP/JPY with levels +/- 1.0

The recommended timeframe is 1 minute.

We use:

Awesome Oscillator

Horizontal (to mark the required levels on the indicator)

Preparing the template

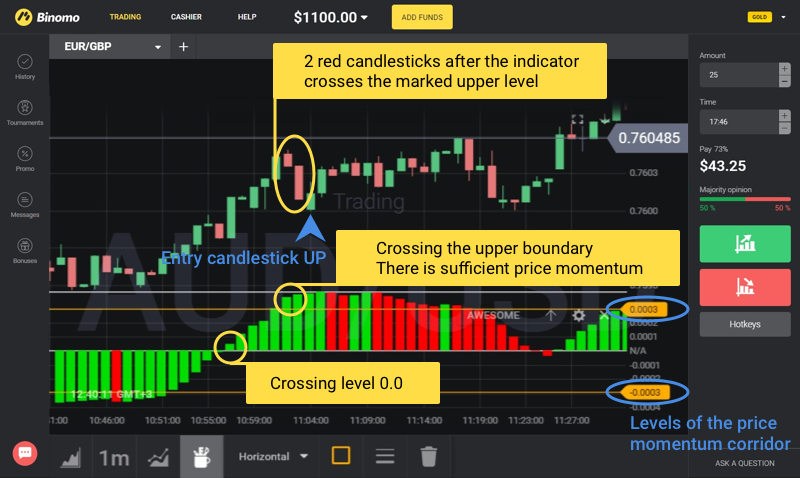

Select the “Awesome Oscillator” and manually mark the required levels on it depending on the asset. This helps to cut out false signals and weak impulses of price movement.

The main task is not to miss the indicator crossing level “0.0”. This is the first sign of a signal to enter. Then you just have to wait for sufficient price momentum.

Trade UP

- The column of the Awesome Oscillator (the green bar of the histogram) crosses the marked upper level.

- On the price chart, we wait for the appearance of two red candlesticks: this is a confirmation signal to enter on a purchase.

We enter a trade on the next candlestick which is slightly above the previous maximum or on par with it. The expiration time is 3-5 minutes. On a low-volatility market – up to 10 minutes.

Trade DOWN

- The column of the Awesome Oscillator (the red bar of the histogram) crosses the marked lower level.

- We wait for the appearance of two green candlesticks: this is a confirmation signal to enter on a sale.

We enter a trade on the next candlestick which is slightly below the previous minimum or on par with it. The expiration time is 3-5 minutes. On a low-volatility market – up to 10 minutes.

IMPORTANT:

- pay attention to the levels on the indicator, as they filter out false signals: until the price reaches these levels, the momentum is too weak, and it’s risky to conclude a trade;

- the basic principle for entering a trade: wait for momentum from the indicator (above the marked levels), then there should be a small correction from the momentum on candlesticks and only after that can you conclude a trade in the direction of the momentum;

- instead of crossing the level of “0.0” the indicator may approach it and “rebound” off of it. This can also be taken as a preliminary signal for a trade.