Nadex Vs. Traditional Binary

What I want to mainly talk to you guys about today is Nadex’s spread trading system. In traditional binary you commonly have to wait for a price to reach your target before you can enter in on the trade. Upon entering the trade you cannot exit it after the fact. You must stay in on the trade until expiry. The outcome is an all or nothing outcome. If the forex strike finishes above your target strike then you will receive a 70%-80% return on your investment. If your trade finishes out of the money or loses then your whole initial investment will be lost. Here is what it looks like for traditional binary.

-You invest: $50

-On the: EURUSD

-To finish above: 1.2345

-In the next: 30 minutes.

-If your price finishes at 1.2346 and above, you win the trade and is given $40 profit + your initial investment which will total out to $90 kick backed to you.

-If your price finishes at 1.2344 and below, you lose the trade and your whole initial investment will be lost.

The reason why this is important is because the limitations of binary binds you in on losing trades and there is nothing you can do about it. This is not the case with Nadex. On Nadex you have the opportunity to exit a trade with optimal profits or minimal loss before the trade expires. Nadex also allows you to choose your strike even if the market has not reached that point. With traditional binary the markets has to reach your target of 1.2345 before you can even enter in on the trade. You may not even always get the price you want since the markets move so quickly at times and pressing the button to enter in on the trade has a 2-3 sec delay sometimes which makes a big difference.

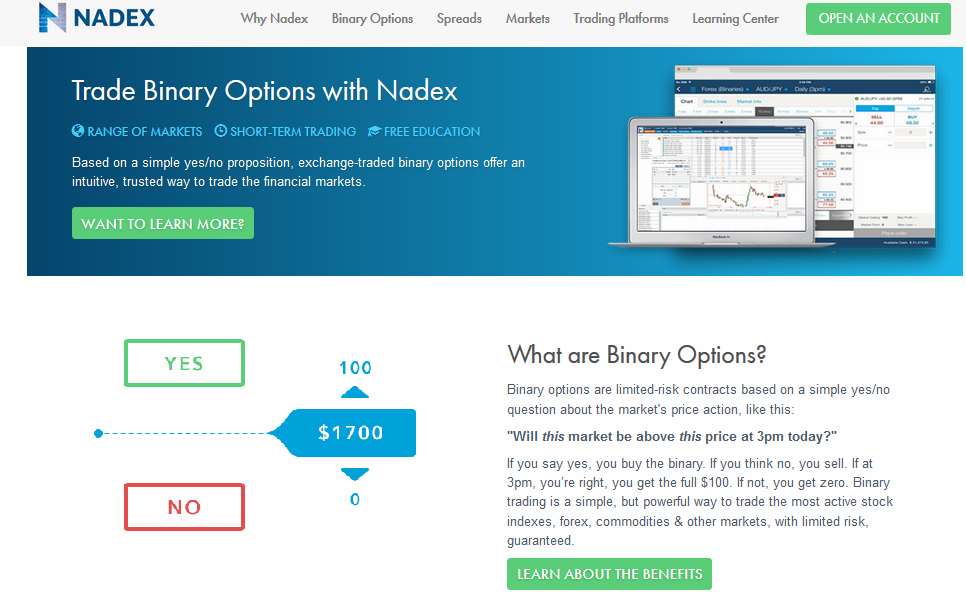

Nadex Pricing

In Nadex all of your entry prices for a particular strike is based on the difference from $100. I do not want to be technical so I will it explain it simply. If you invest $75 then you will get $25 if your trade wins. If you invest $50 then you will get $50 if your trade wins and if you invest $40 then you will get $60 if your trade wins. If your trade loses then you will lose your whole initial investment. The luxury is that if you feel that your trade will lose then you can exit the trade early and get potentially 50-100% of your initial investment back.

Nadex Risk/Reward

The reason you get less profits with the more money you risk is because the higher the risk means the higher probability of that potential strike winning. A strike that cost me $75 usually has a 75% chance of winning at expiry. Because it is more sure money then it will cost more. The reason only a low $40 investment will give a great profit of $60 is because the strike for that price usually has a 40% chance of winning at expiry, which is significantly low probability. The beauty of Nadex though is that the higher probable strikes are so easy to win thus they become the most preferable choice of trading. Here is an example below of what Nadex strikes look like.

Lets say you are doing a BUY/CALL/UP for the EURUSD and your target strike that you believe will win is 1.2345, this is how it may look on Nadex.

1.2365 BUY for $40 ß This is higher than your target strike and current market making it harder to win.

1.2345 BUY for $50 ß This is right at your target price giving you a 50/50 chance of winning.

1.2330 BUY for $75 ß This is below your target price thus giving you a better chance of winning.

If you enter in at a higher risk then remember you can always stop loss and exit if you feel the trade will potentially lose in the worst case scenario.