Post-News Trading with binary options

Your capital may be at risk. This material is not an investment advice.

A number of important economic events take place on a daily basis, these include earnings reports, meetings, speeches, elections. Most of such events tend to affect the market in the short term. This article looks into the ways your trading can be improved if you keep an eye on the economic calendar.

Depending on the importance of the news and published numbers, quotes can increase or decrease for some time. No market analyst can predict how long the market trends will last. However, by reversal candlestick patterns, you can determine the increasing probability of the price adjustment. For many traders a reversal candlestick pattern is a signal to enter the market.

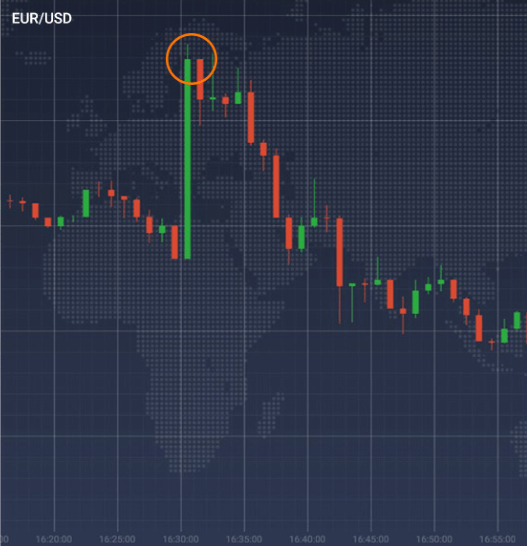

Example No. 1

A number of important news from the US, including such reports as Retail Sales and Producer Price Index (PPI) was announced at the start of the US trading session. Actual results were much worse than expected, and the US Dollar plunged significantly against the euro. After having hit the critical level, the rate started the reverse movement and the first backward candlestick was formed. It is a signal that a further change on the price chart is expected, and that is exactly what happened.

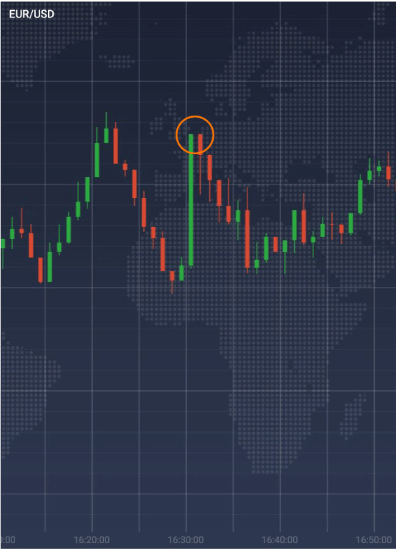

Example No. 2

In the majority of countries, GDP (Gross Domestic Product) data is published twice a month – both preliminary data and actual results. Significant changes in this data (even for preliminary data) can have a massive impact on the market. In this case, the actual results match the expectations of the market participants, yet the government expected these numbers to be higher, and that is why the USD weakened against the EUR. Afterwards the rate hit a critical level and a turnaround movement followed.

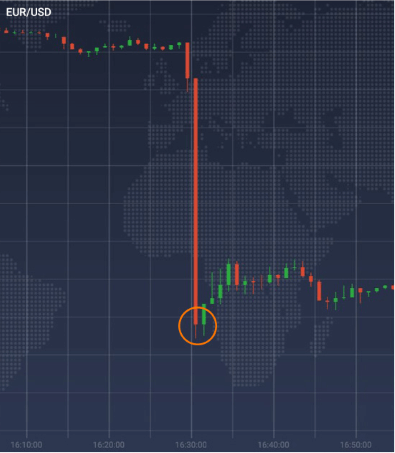

Interest rate decisions and press conferences held by political leaders or the heads of central banks are considered to be the most important economic events, along with the popular report on NonFarm Payrolls.

Market reaction to these economic events is much more predictable than to other types of events, and usually the price fluctuations start 5-7 minutes after the news breaks (depending on the difference between the actual results and the forecast).

Example No. 3

The example below is the market reaction to the publication of the NonFarm Payrolls report. Actual data was much better than the forecast, and the USD strengthened against other assets (in this example – against EUR).

Usually, traders who use this method consider the Net Profit Trading money management approach in order to decrease the risks of unpredictable rate movements during such volatile periods.