Powerful Combination : Alligator & Fractals

Your capital may be at risk. This material is not an investment advice.

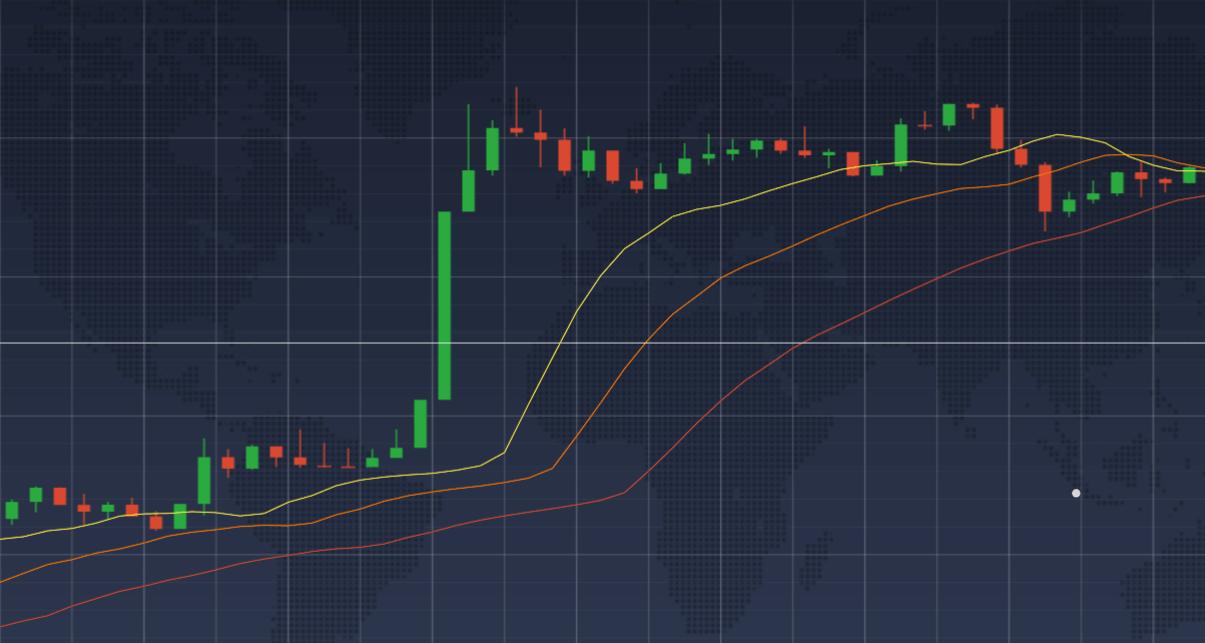

This article is dedicated to one of the most powerful combinations of technical analysis tools. The Alligator and the Fractals used together have a potential of providing strong and highly accurate forecasts. The indicators can be applied to any asset and on any time frame.

The Alligator is a technical analysis tool consisting of three lines overlaid on a pricing chart. The lines represent the jaw, the teeth and the lips of the named animal. The indicator is used to determine the trend and predict its future direction. The Alligator works best when combined with an oscillator-type indicator. And the Fractals seem to be one of the best choices. The Fractals are recurring patterns that can predict reversals among larger, more chaotic price movements.

Both tools were introduced by pioneer of market psychology and legendary trader Bill Williams in his 1995 book “New Trading Dimensions”. The main purpose of these indicators is to show the emerging market trends and determine optimal entry and exit points. They can be applied to any time frame and asset.

How do the indicators work?

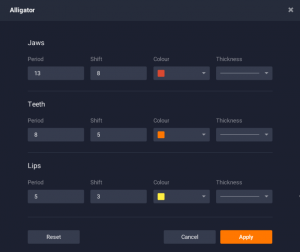

The Alligator indicator is a combination of three smoothed moving averages with periods of five, eight and 13, which are all Fibonacci numbers. Each of the lines is shifted ahead for a certain period, that depends on the short- or long-term orientation of that particular line.

1) The Alligator’s Jaw (red) is a 13-period SMA, moved into the future by 8 bars;

2) The Alligator’s Teeth (orange) is an 8-period SMA, moved into the future by 5 bars;

3) The Alligator’s Lips (yellow) is a 5-period SMA, moved into the future by 3 bars.

The following analogy is used to describe the way the indicator works. Sideways trends are marked with the alligator’s closed mouth — all the three lines approach each other and occasionally intersect. When the alligator is sleeping, the majority of careful traders avoid making new deals. The longer the Alligator waits, the hungrier it gets. Long periods of sideways trends are interspersed with strong bullish/bearish periods, and the Alligator is good at catching these moments.

When the trend takes shape, the beast opens its mouth and the basic lines move farther apart. The stronger the trend, the wider the alligator’s mouth will open. When the beast is sated it returns back to the resting state, the lines become horizontal and focus in a narrow corridor.

Fractals

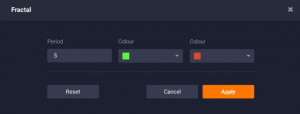

The Fractals are used to identify emerging trends and warn the traders of upcoming investing opportunities. The Fractals come in two different forms:

1) A bearish turning point occurs when there is a pattern with the highest high in the middle and two lower highs on each side.

2) A bullish turning point occurs when there is a pattern with the lowest low in the middle and two higher lows on each side.

Setting up the indicators

Setting up the indicators in the IQ Option trading platform is easy.

To activate the Alligator indicator, click on the “Indicators” button in the lower left corner of the screen. Then choose “Alligator” from the list of possible indicators.

Click the “Apply” button without changing the settings. The Alligator graph will then be overlaid on the price chart.

To activate the Fractals indicator, click on the “Indicators” button in the lower left corner of the screen. Then choose “Fractals” from the list of possible indicators.

Click the “Apply” button without changing the settings. The Fractals will then be overlaid on the price chart.

How to apply in trading?

Though each of the indicators can be used separately, the Fractals and the Alligator, as noticed by the Bill Williams himself, work best when used simultaneously to confirm each other’s signals. Generally, all buy signals provided by the Fractals indicator should be considered valid if only below the Alligator’s central line (orange). Similarly, all sell signals should be above the Alligator’s central line (orange) in order to be valid.

Things to consider

- Being the trend following indicators, the Alligator and the Fractals are lagging behind the actual market.

- It is possible to boost the accuracy of both indicators by increasing the period. The number of generated signals will, however, decrease.

- Signals should be checked on different time frames for maximum predictive potential.

- The Alligator and the Fractals work best when used simultaneously. Using only one of the above signals can be risky.