The “Market Breath” strategy

Keep an eye on the quote chart: often before continuing to rise or fall, the price will make a short-term pullback, and after reaching an invisible level, it will continue to move in the direction of the main trend with new force.

Concluding a transaction on a “rebound” is considered by many to be a great success. In fact, determining the rights levels is easy enough. It only takes the “Moving Average” indicator and a little patience.

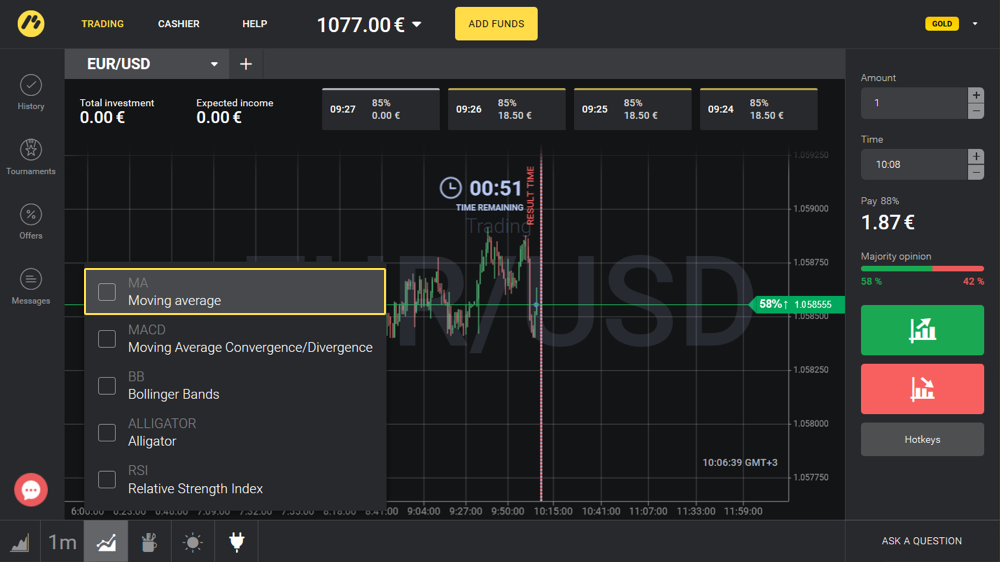

Preparing the template

Apply the “Moving Average” indicator to the quote chart with the default settings:

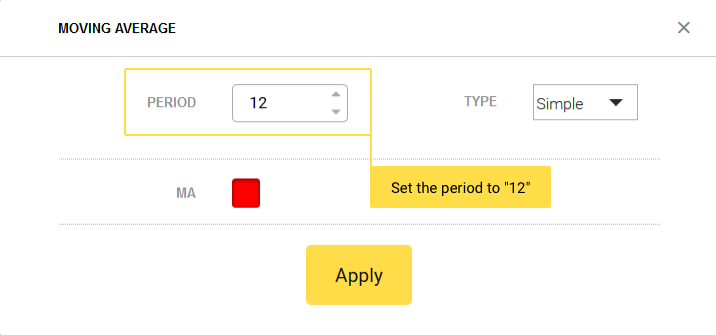

Add another moving average with a period of “12”:

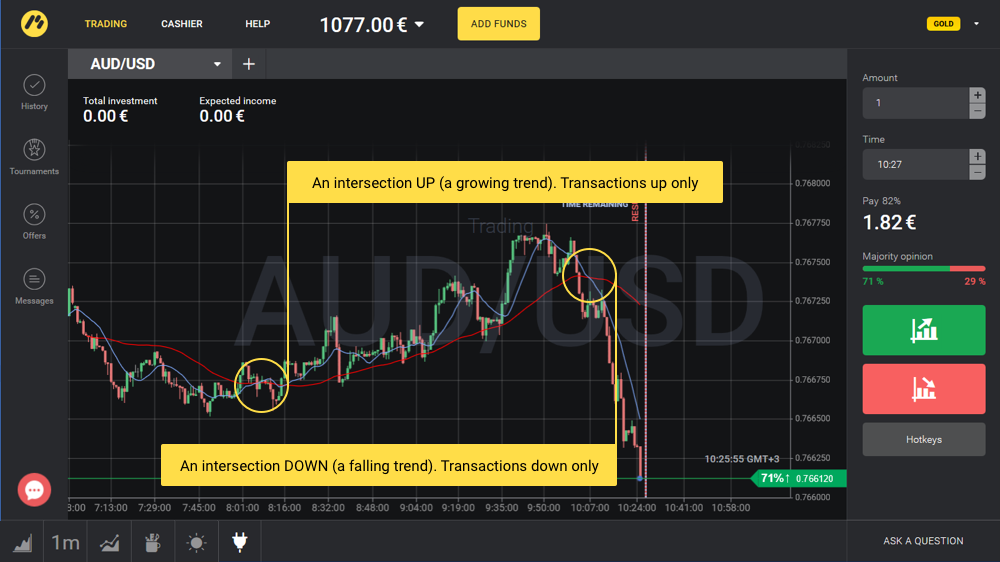

The intersection of these moving averages will help us identify a trend in the direction of which transactions will be concluded:

How to conclude transactions

The main task is to catch quote “pullbacks” in the area of the moving average and conclude transactions on the trend, the direction of which is shown to us through the intersection of moving averages.

Look at the screenshot above: asset quotes perform these “breaths” (pullbacks to the moving average) often enough, and after almost every correction the price rebounds in the direction of the trend, increasing the likelihood of closing transactions with gains.

Transactions on an increase are concluded when the following happens:

- Moving averages intersect in an upward direction

- During correction, quotes of the traded asset touch the moving average with a period of “50” (the indicator with default settings):

Transactions on a decrease are concluded when the following happens:

- Moving averages intersect in a downward direction

- During correction, quotes of the traded asset touch the moving average with a period of “50”:

IMPORTANT! The “Market Breath” strategy refers to trends (trading is conducted only in the direction of the trend), so choose the time between 07:00 and 16:00 UTC when asset quotes are the most volatile.

Expiry periods

To trade on the strategy, select timeframes from 15s to 1m. This will make it easier to catch the next “breath” of the market.

Expiry periods should be set in such a way that after the conclusion of the transaction, at least 10 candles are formed.

With the timeframe of 15s, the expiry period should be around 3-4 minutes, and for the timeframe of 1m, starting at 10 minutes.

Money management

Don’t forget about the rules of money management! To save capital, conclude transactions worth no more than 3-5% of the size of your trading account.