The Stochastic Oscillator

The Stochastic Oscillator is a momentum-type indicator that determines overbought and oversold positions. In other words, it can provide the one with information on when to enter or leave the market. The indicator is also used to predict future performance of the underlying asset. It was created and introduced by George C. Lane in the 1950s.

How does it work?

According to Lane himself, the indicator “doesn’t follow price, it doesn’t follow volume or anything like that. It follows the speed or the momentum of price. As a rule, the momentum changes direction before price.” The indicator, therefore, is capable of predicting trend reversal points, which is crucial for successful Forex trading.

The Stochastic Oscillator returns the ratio between the last closing price and the high-low range during a set period of time. It is based on the premise that during the uptrends, prices will be above the previous period closing price. Alternatively, during the downtrends, prices will likely be below the previous closing price.

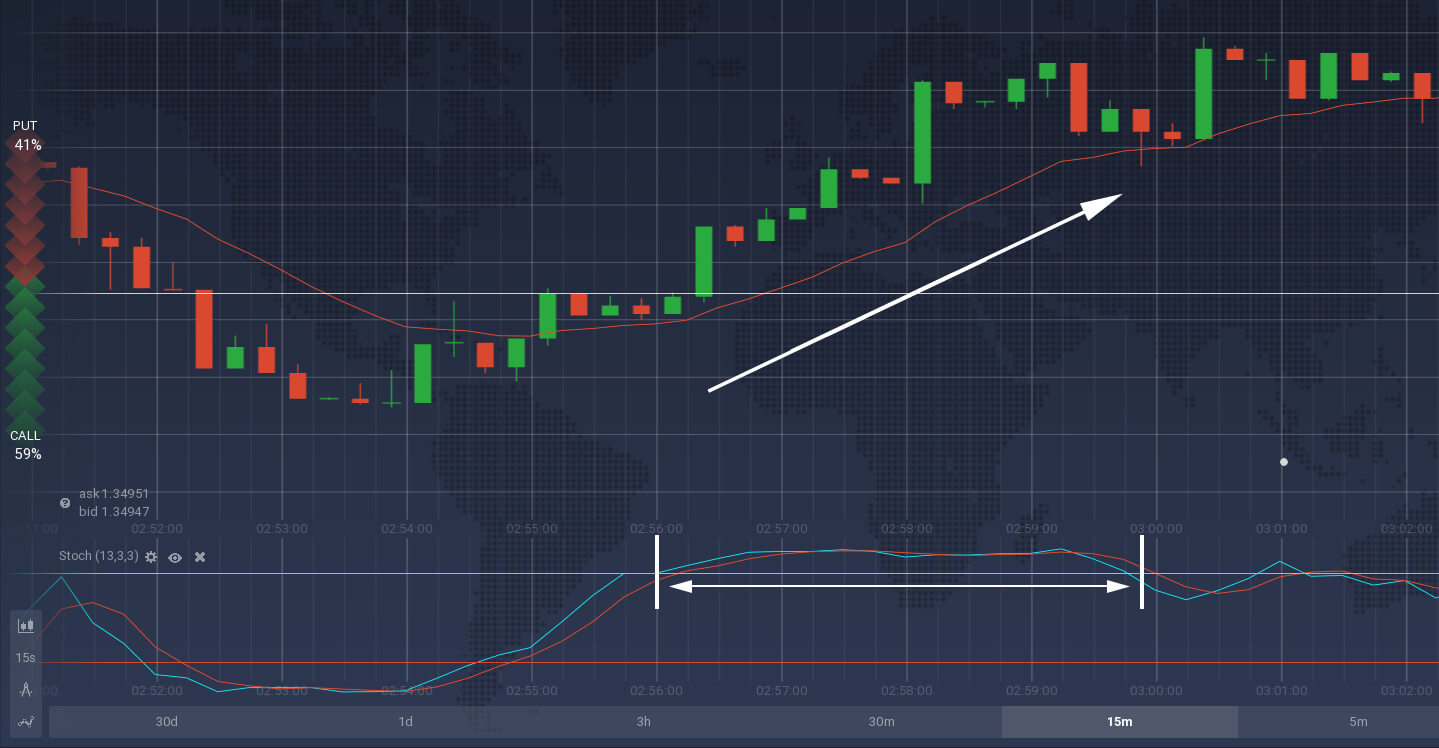

The oscillator consists of two horizontal and two moving average lines (the fast and the slow ones). The fast moving average line is by default has a period of 3, while the slow MA has a period of 13. The oscillator ranges from 0 to 100. Oversold and overbought levels, by default set at 20% and 80% respectively, coincide with two horizontal lines.

When the fast and the slow moving averages remain above the 80% level, the asset is considered to be overbought. When both lines remain under the 20% level, the asset is oversold. It should be noted, however, that oversold readings are not necessarily bullish, as securities can remain in the oversold zone for quite some time without leaving it. Similarly, overbought reading does not always indicate an urge to open a “Put” position. Securities can remain overbought for relatively long periods of time during a strong uptrend.

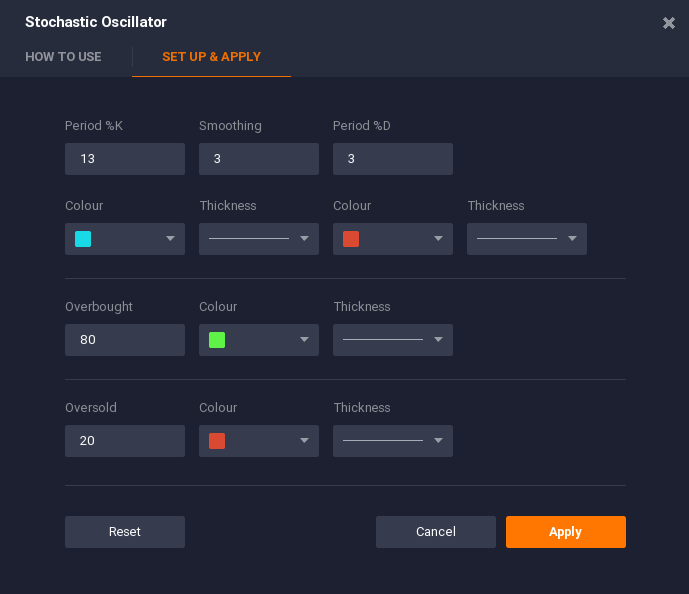

How to set up?

Setting up the Stochastic Oscillator indicator in the IQ Option platform is easy.

Click on the “Indicators” button in the bottom left corner of the screen. Then choose the Stochastic Oscillator from the list of possible indicators.

Go to the “Set up & Apply” tab and, if you want to use the indicator with standard parameters, simply click on the Apply button.

Or you can adjust the indicator to your liking, changing %K and %D periods, as well as overbought and oversold levels for higher accuracy (alternatively, more signals).

The indicator will appear in the bottom part of the screen, right below the price chart.

How to use in trading?

The indicator’s main purpose is to reveal the overbought and oversold levels and give traders a hint on when to open a potentially profitable position. There are several ways to determine such cases with the help of the Stochastic Oscillator, of which the following two are the most trustworthy.

1. Overbought and oversold levels

Overbought Indication

When both slow and fast moving averages are above the overbought level the trend can be expected to become bearish. The fast MA crossing below the slow MA is an additional signal of an upcoming downtrend.

Oversold Indication

When both slow and fast moving averages are below the oversold level the trend can be expected to turn bullish. The fast MA crossing above the slow MA can become an additional signal of an upcoming uptrend.

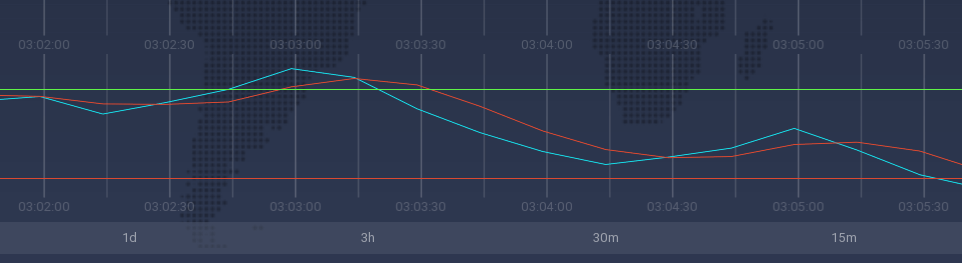

2. Divergence

When the indicator and the price action start moving in different directions, it can be perceived as a signal of an upcoming trend reversal. Divergences can be both bullish and bearish, as well.

Conclusion

The Stochastic Oscillator is an extremely useful and interesting technical analysis tool. For maximum efficiency, it can be combined with other momentum indicators and trend-following indicators. Caution may be needed when working with the indicator, as oversold and overbought level do not necessarily correspond to a soon trend reversal.

NOTE: This article/material is not an investment advice.