Trading Digital Options

A Digital Option is a new trading tool developed by IQ Option. It combines features of both classic and binary options. A digital option provides an opportunity to trade a variety of instruments. The profitability and the risks of each deal will depend on a manually chosen strike price, which is its main distinctive feature.

Breaking Down Digital Options

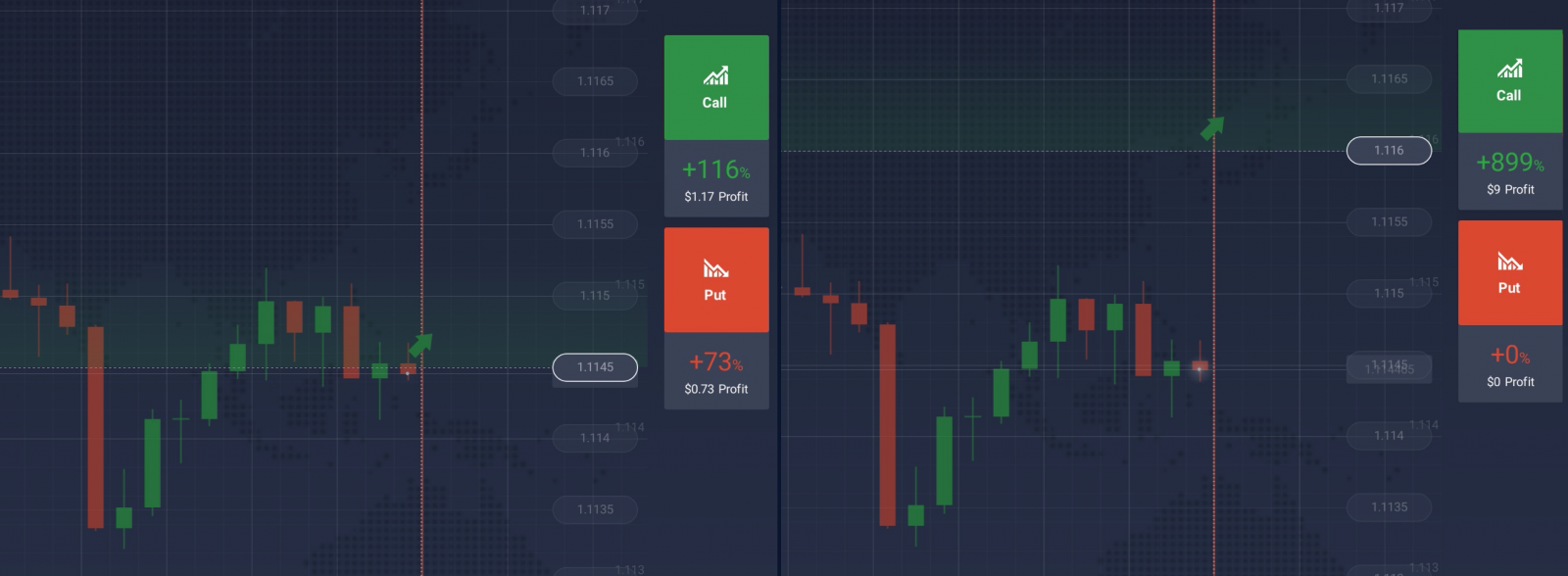

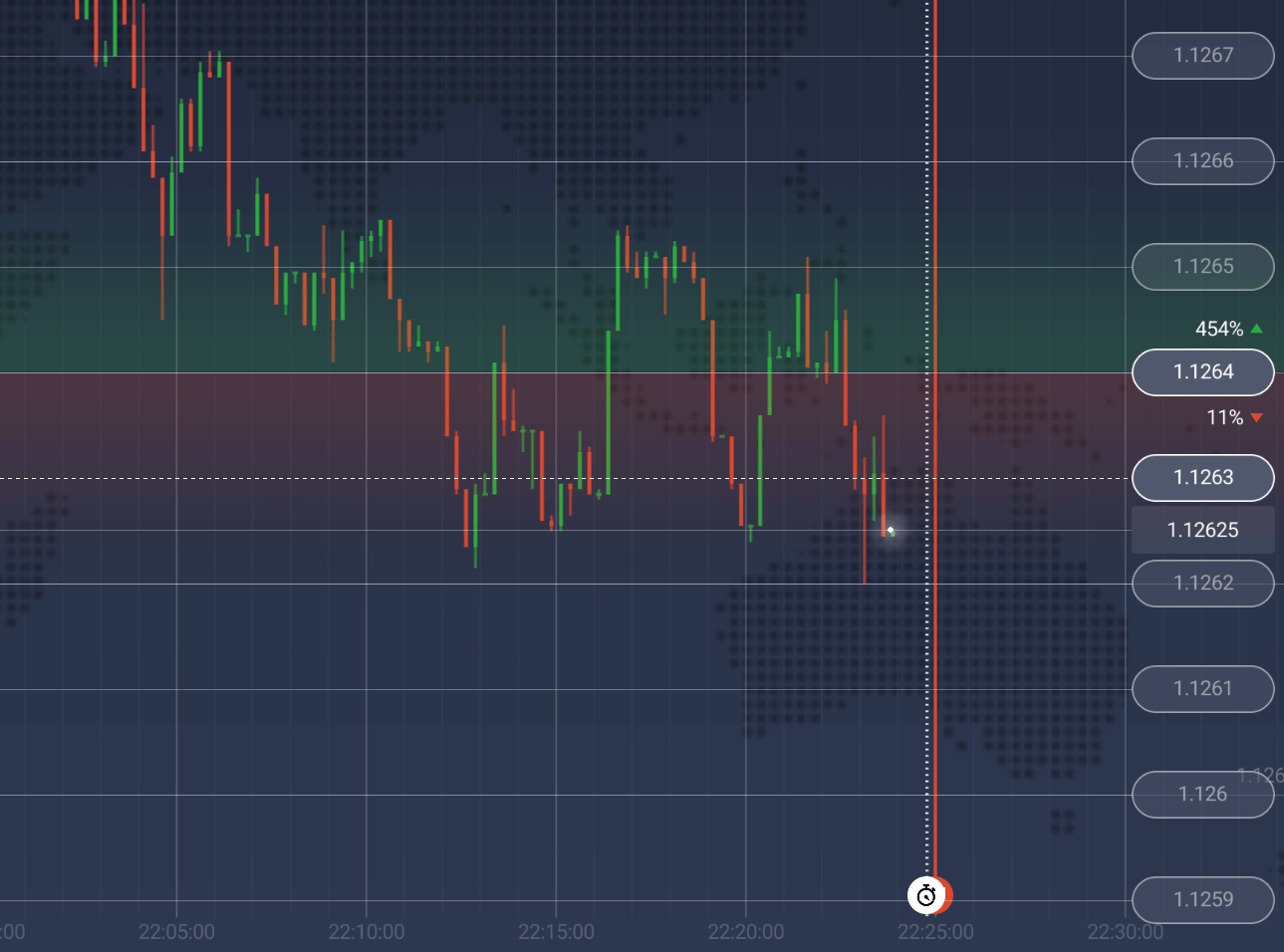

Digital Options offer a high degree of freedom and a higher earning potential than binary options, the profitability of which is predetermined. A trader can vary the amount of potential profit and risk by simply adjusting the strike price. When moving the strike price closer to the current level of prices, a trader will decrease the potential profitability of the deal and at the same time limit the amount at risk. Conversely, a trader can take the additional risk by pushing the strike price further from the actual prices and hope to receive higher profit.

A Digital Option can also be sold before the expiration date. If the trader feels that the trend is taking the wrong direction, he is free to sell the option at any time. The deal can be set up with just a few clicks. Here are the steps you would want to take in order to do so.

Trading Digital Options

To make a deal the investor is required to take the following steps:

- Choose the desired asset,

- Choose the amount of money he wants to invest,

- Select a strike price,

- Click “CALL” if he believes the price will go up or “PUT” if the price in his opinion is supposed to go down.

- Wait for the expiration time to come or sell the option prematurely.

Basically, there are only two parameters apart from the asset type the trader will have to adjust when setting up a deal: the amount of money invested and the strike price. Nonetheless, the number of strategic options available is high. Depending on various factors, some traders will consider it unwise to choose the strike price that is too far away from the current price level if they believe the price will simply not reach the desired level. Some other traders will go for a higher/lower strike prices, being ready to accept the additional risk while chasing higher returns.

Mitigating the Risk

Risk management rules apply to digital options deals too. Some traders believe that allocating more than 3% of one’s trading capital to a single transaction is too risky and does not help trading in the long run. Taking your time to learn and practice different trading strategies and techniques on a Practice account is always highly recommended.