Trading on breakouts in the price corridor

What is a breakout in the price corridor?

You can find out what a price corridor is in the strategy “Trading in the price corridor”. And now we will look at what a breakout in the price corridor is.

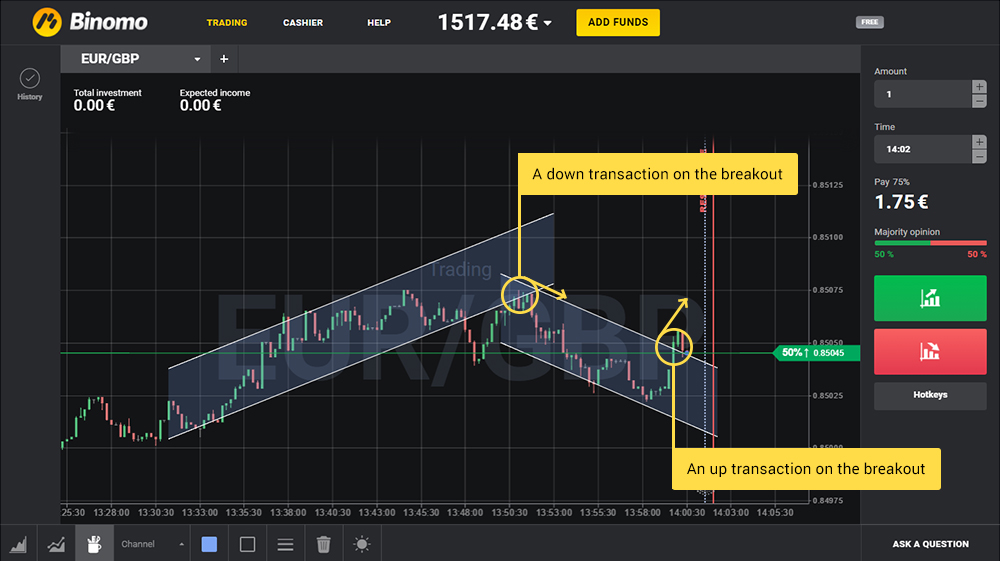

By moving within a certain price range, asset quotes form two levels: the level of support (which determines the upper limit of the range), and the resistance level (defining the lower limit of the range).But the price may not always move in one and the same channel. Due to the release of important macroeconomic news or large trading position transactions in the asset market, quotes can cross the channel’s boundaries to turn in the opposite direction or to speed up their movement. In the quote chart, it looks like this:

In the picture you can see how, by breaking through the channel’s lower border, the asset quotes continue to move for a specific time in the opposite direction. This amount of time is quite enough for a trading position in the direction of the breakout to be concluded within the expiry period and with a profit. Also, as seen in the illustration above, after the breakout of the channel, for some time, the quotes rolled back for correction and pushed off from the outer boundary of the channel, continuing to move in the direction of the breakout. This asset quote maneuver is carried out in an overwhelming number of cases of breakout, which gives the trader the ability to conclude transactions at the best price.

How to trade on breakout in the price channel?

To trade on breakout in the price channel, the following is necessary:

Determine the current price corridor in which the price is moving. In other words, put parallel lines on a few highs and lows of the price range:

Determine the current price corridor in which the price is moving. In other words, put parallel lines on a few highs and lows of the price range:

Wait for a steady breakout of the price channel and correction of the quotes in the area of the outer boundary of the corridor:

Conclude a transaction on the rebound of quotes from the outer boundary of the channel:

Similarly, you can develop a breakout of all of the following price corridors which arise in the course of price movement:

The trading strategy for breakout of the price channel works well with trading within the channel. In this case, if you conclude a transaction on the rebound inside the corridor, and the price continues to move and breaks through its border, you can immediately conclude a transaction on the breakout, blocking losses on the previous position, and the end result is double the profitability of your option trading.