What are binary option ladder trades?

Ladder options provide you a wide range of levels, basically there are five different levels of price ranges that are determined by pivot points, usually every pivot point is set by a support or resistance level so once it reaches the price level you trade, you will receive the payout.

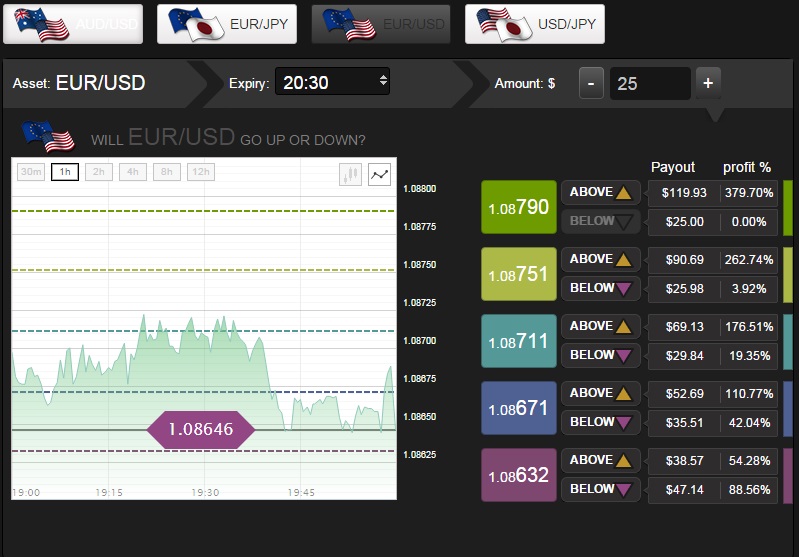

For example, looking at the image below, it enables you to trade by different price levels, for each level there is a different profit rate, where the most likely to happen gets less profit rate and vice versa, there are some cases where the profit rate can reach a level of almost 1000%!!

That’s why they are called Ladder options, because you have different price levels you would like to reach, defined by pivot points it’s like climbing a ladder

In the example below, the price the is most likely to happen is already “Within the Money” therefore it gets profit rates of 3.92% , on the other hand the less likely to happen gets 380%.

That’s why ladder options became so popular, if you know what you can expect from the market and know when to be conservative with your risk and when to go wild, that’s a platform you can gain a lot more, eventually it increases you chances to win.

Here are step by step guide on how to trade ladder options

- You pick your asset, currently, brokers allow you to choose between major currencies only, I assume that it will be expand for more currencies and even other asset types such as commodities, indexes and stocks.

So for now you can find majors like EUR/USD, USD/JPY, AUD/USD, EUR/JPY

- Pick your expiration time, usually you get few or one expiration Time

- Adjust the amount you like

- Review the chart that is already set with 5 pivot points, usually the pivots are set by the resistance and support levels

- For each pivot level review the profit rate

- Estimate your chances to win

- Hit the option you estimate that the market will reach, you may select as many options you like for the same expiration date

When is the best time for ladder option trading?

There are many strategies to use ladder options, the best conditions to use it is when the market is volatile, it can be also before an important event on the Market such as currency rate update, GDP or any other important event.

Imagine you place an option just before an important event and you estimate there will be a battle between buyers and sellers, in such cases you may want to place a call option and a put option at the same expiration date, you can win from both strikes.

Another strategy that fits to low volatile is “Within the Money” price level, but, in order to take advantage of this, you need to calculate first the number of trades you need to win against one lose.

For instance, if the chances to win a ladder option that is within the money is between 3%-5%, you will need to win at least 20 options before in order to double the initial amount, otherwise you will lose more than you gain.

Which brokers provide to trade ladder options?

Not every broker provides them, but more and more brokers developing their platform to enable this advanced platform, here is a list of popular brokers that currently provide ladder options:

- Finpari

- Binarium

- Spotoption

Because ladder options are more complex platform than others, it is recommended to use by an experience traders, once you feel comfortable enough with basic binary option trading types you can then move forward to ladder options, at the beginning you may find it very attractive with its huge profit rates, but it is recommended to take it slowly and first trade with price levels that most likely to happen.

Only after you gain more experience with ladder options you can try one of the strategies the platform can offer.

Ladder option strategy for beginners:

Low volatile market strategy, this strategy is great for beginners on ladder options,

Place your options to be “in the money” for call option followed by “in the money” put option, if the market price stays within the range you will gain from both options.

Remember to use this kind of strategy when you feel the market is less volatile, you should also take into consideration market events.

As a thumb rule before you place your ladder option trades you should know the support and resistance levels of the asset you choose, it is best to mark the trend as well and to understand where are the breaking out points.