Trade in flat

In the evening and at night the market “flats”: it moves calmly within a price corridor. Fluctuations are small, but predictable. Now we’ll tell you how to determine the turning points of quotes in flat.

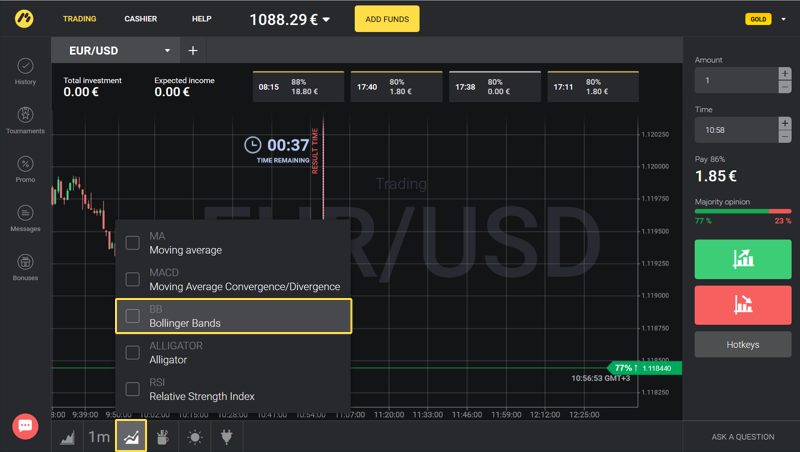

Preparing a template

First, choose the Bollinger Bands indicator with the default settings. It will show the moments of maximum price deviation from its mean value.

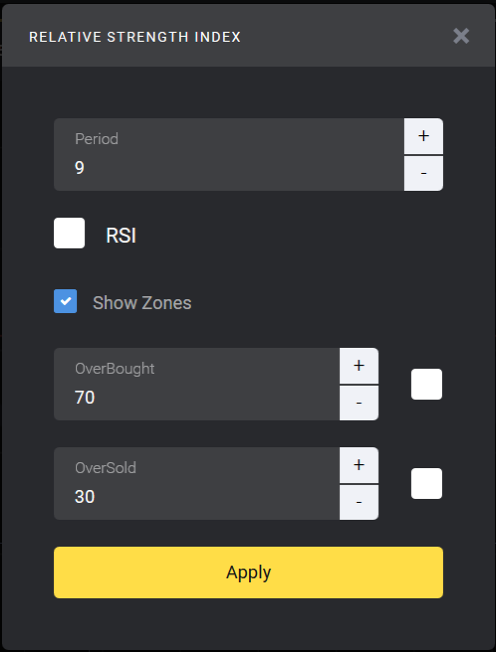

Then select the RSI (Relative Strength Index), which will indicate price reversal points. Apply these settings:

- Length – 9

- Overbought level – 70

- Oversold level – 30

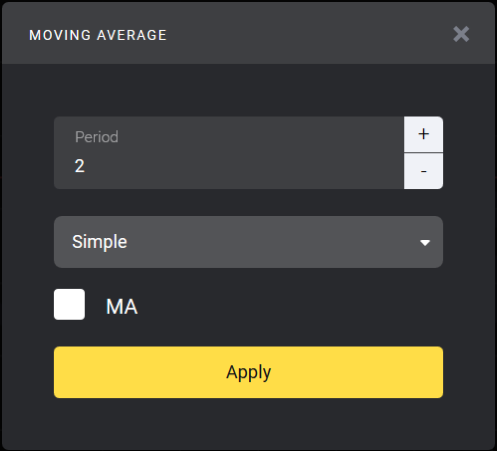

Add the Moving Average indicator. It determines the current (short-term) trend, and namely in this direction entering into transactions is advised. We set as follows:

- Length – 2

- Type – Simple

- Color – white

How do you conclude transactions?

In contrast to the trend, flat is characterized by a horizontal and low-volatility trend. Trading in this market is best within price channels. Once you have prepared the indicator template, you must wait until the asset quotes reach the top or bottom of the price channel and conclude a deal on the quotes rebound inside the channel. Now let us explain in pictures.

A transaction on asset price increase is concluded when:

- The moving average has crossed the lower Bollinger limit and then the candlestick has closed by growth inside the channel

- The line at the RSI has crossed the level of 30 down

A transaction for a price fall is concluded when:

- The moving average has crossed the upper Bollinger limit and then the candlestick has closed by a fall inside the channel

- The line at RSI has crossed the 70 level up

Time and assets for trading by strategy

The strategy demonstrates the maximum efficiency in the evening and at night, starting from the second half of the US session (from 16:00 UTC) until the end of the Asian session (until 06:00 UTC).

There are stock assets that are in flat for most of the day. On the Binomo platform, they are represented by currency pairs CAD/CHF, AUD/CAD, EUR/GBP, and Gold asset. The “flat” version of the “Pathfinder” strategy can be used with those around the clock (except at times of important macroeconomic news publication).

Expiration periods and money management

For market analysis with this strategy, it is recommended to use a timeframe of 1m and term expiration of not less than 5 minutes.

We recommend not entering into transactions that are larger than 2% of your trading account.