Price Action FX Review – (30.10.2017)

We are starting a new week in the markets. Last one was extremely interesting and there were a lot of investment opportunities. You can read about my positions and new potential entries below:

AUD/JPY:

Pair reached key support and rebounded from it on Friday. However, there was no buy signal complying with price action (Price Bar, Fakey, Inside Bar) still its worth observing next candles. Maybe an Inside Bar will form today and you can play it depending on the situation, either short or long.

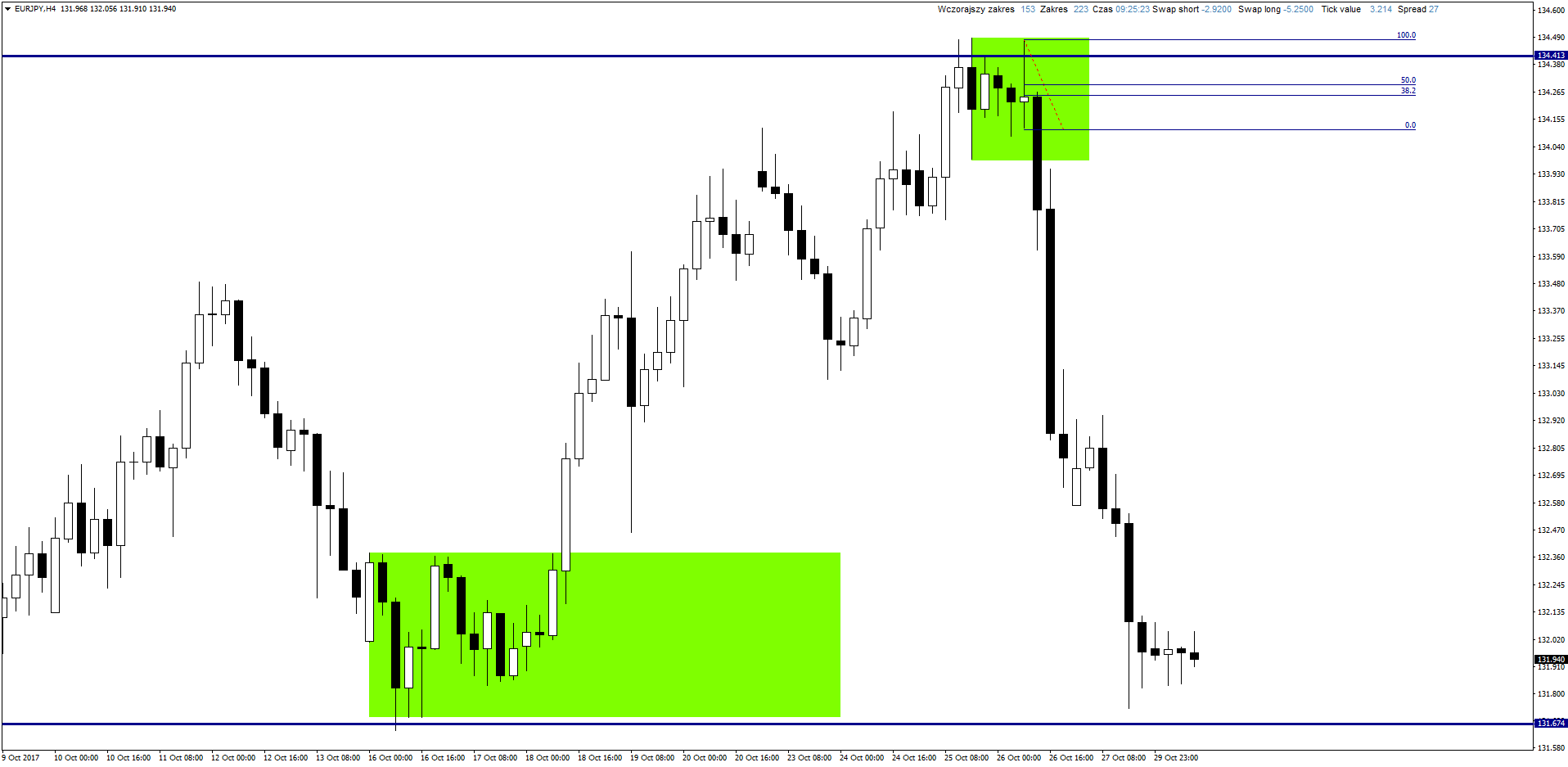

EUR/JPY:

I regret the missed trade on Euros to Yen. It took a few pips to open the position, which would end up already with Take Profit. Stop Loss was only 25 pips and the target was around 250. Nearly 20% profit of the account missed me in this case, but this will happen if the setups are at 50% of the signal candle (formation).

EUR/USD:

The pair has fallen below key support and is now waiting for a correction. Ideally, if it reached the area of the mentioned level, which should now be a resistance and the sell signal from the H4 charts would appear. Currently, we need to wait and watch but the direction seems clear.

GBP/AUD:

Unfortunately Stop Loss on the position with potential 30:1. The opening price was slightly below the level of SL. There was another pinbar candle, after which it was possible to enter again into a long position with equally great potential.

NZD/USD:

Pair reached key support and on Friday strongly rebounded from it. I set a buy limit order at 50% of the signal candle abolition and the position was opened. Stop loss is about 40 pips, and the target for the nearest resistance is 330, also again very good potential R/R ratio.