How Can We Use Oil Prices Movements?

Opec’s announcement in November of last year came as a surprise to many market participants as it was the first production cut in eight years. Nonetheless, the announcement produced the intended effect with oil prices gaining significant ground immediately.

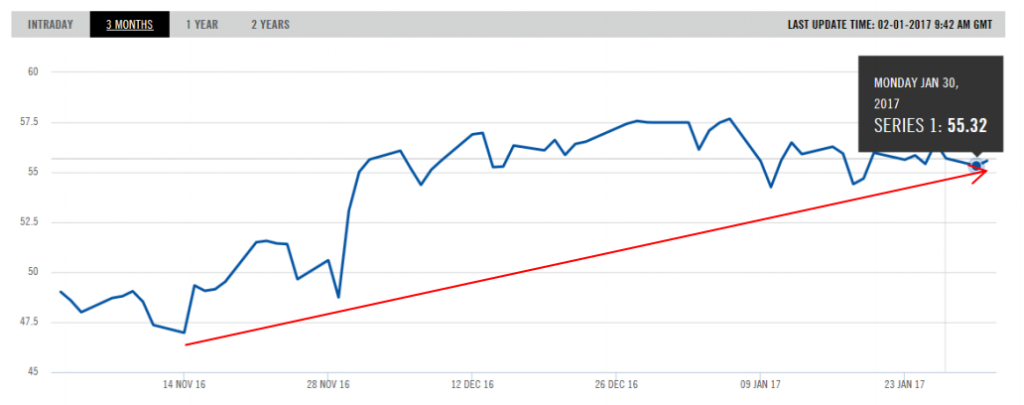

The ICE Brent Crude April contract has gained almost 18 percent since the supply constraints were announced in November. (Fig 1)

Over the same period the Nymex March WTI contract also gained close to 14 percent. (Fig 2)

The agreement made between OPEC members alongside non-Opec nations such as Russia set out plans to reduce oil production by 1.2 million barrels per day to an output level of 32.5 million barrels per day. The policy took effect from the start of this year, however, during the last weekend of January 2017 OPEC officials revealed production cuts were ahead of target with cuts of 1.5 barrels per day under implementation.

Alongside the supply side investment case and share price momentum a further argument for going long the oil market at this time is that hedge funds have been increasing their long oil positions. Exchange data for January 2017 has indicated the net long position of speculators (defined as the difference between long positions and short positions) in North Sea Brent crude and WTI has risen to the equivalent of 820 million barrels. This figure is the equivalent to just under nine days’ worth of global oil demand and is a signal to the market that institutional investors believe the production cut will be effective in boosting the oil price and is a strong driver of upward momentum for the wider market.

How Can We Use Oil Prices Movements on IQ Option

Oil prices strongly affects currencies of oil-producing countries, such as Canada and Russia. USD/CAD and RUB/USD currency pairs are already on a good move against the dollar.

Crucially investors will need to maintain a close eye on the US shale sector – as this will be the biggest threat to returns for holders of oil positions. If shale output increases significantly the competing supply of this alternative source will lead to a depression in oil prices and counteract the OPEC production cut policy. This could furthermore lead to panic moves from members of the agreement – in particular Saudi Arabia, Iraq and Iran (the three largest producers) voiced some of the strongest objections with cuts pre-agreement – and we may see nations break the agreement in these low probability circumstances.