Average buy/sell

There are times when you open a transaction, and the quotes immediately turn around. What to do? Lose money? No way! There is a special trading trick for such instances. And we’ll share it with you!

What is average buy/sell?

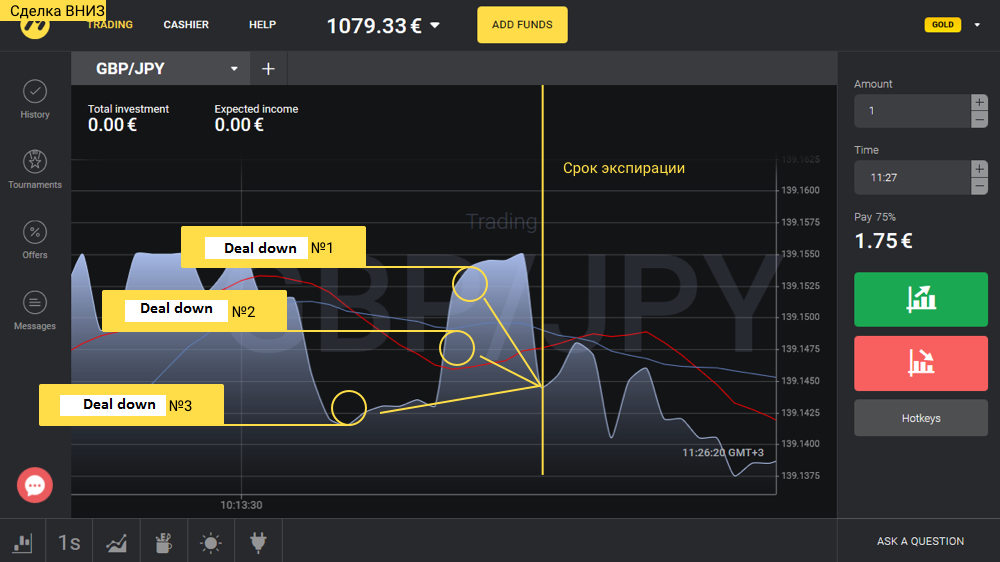

Average buy/sell is a tactic when new profitable transactions are added to a losing one. As a result, when a trader closes trading positions, he covers the loss.

The formula is as follows: -1+(1+1)=1

(Loss+(Profit+Profit) = Profit)

How does it work?

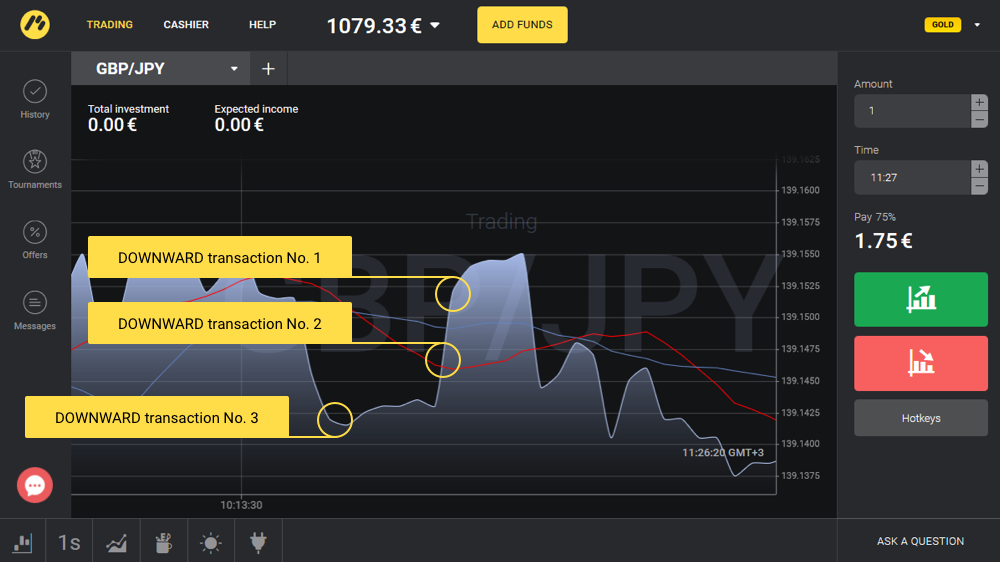

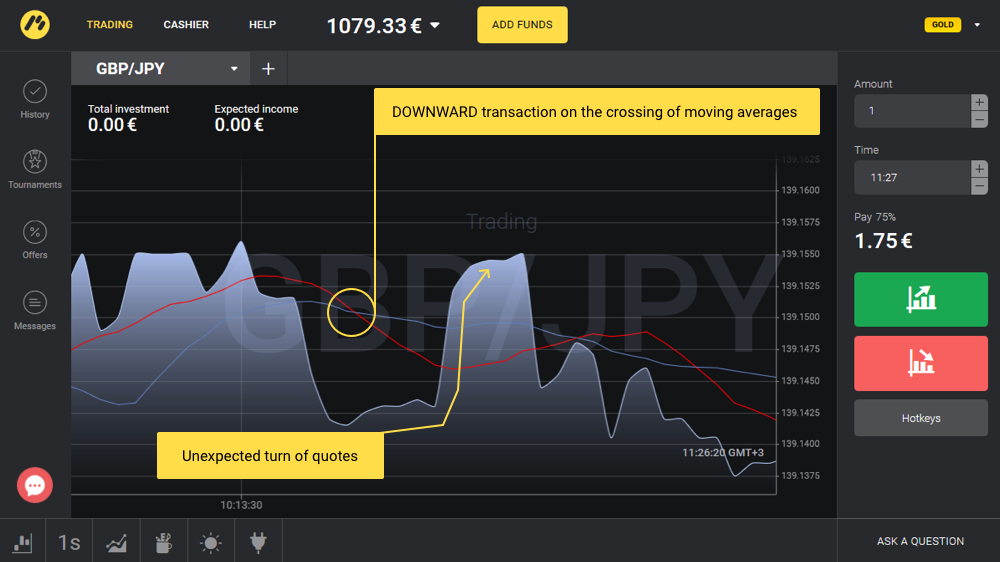

Imagine the following situation. Focusing on the signal of “moving averages”, you made a downward transaction. But despite the forecasts, the quotes started to go up, and the transaction turned out to be unprofitable:

This is the kind of situation that is suitable for average buy/sell. Wait for the price to rise even more and make another DOWNWARD transaction. The price continues to rise? One more such transaction!

The quotes undulate. Chances are that by the end of the expiration period you will have at least two profitable transactions covering for one unprofitable transaction:

Money management

Average buy/sell helps trade profitably significantly more often than when using only one transaction until the end of the expiration period. But only if you have a reasonable approach.

As mentioned above, average buy/sell is just a tactic. You might have guessed that it is going to work well only with asuitable strategy.

One of the main trading rules is that the price of the transaction should not exceed 2% of the deposit. But when you use average buy/sell, this bar should be even lower! Use no more than 1% for each transaction (so that the total amount of the transactions does not exceed 3% of the deposit). This will make it possible to avoid big losses if the quotes don’t turn in the right direction.

And, of course, always use a demo account topractice new strategies and tactics.