EUR/USD – Germany Unemployment & Manufacturing Data

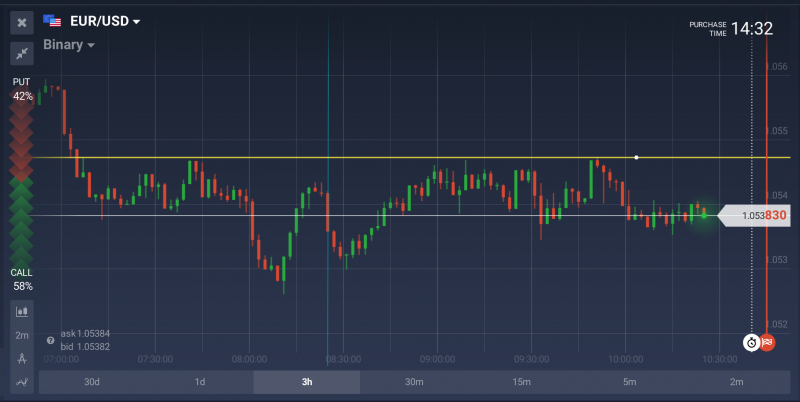

The Euro (EUR) extended its losing streak against the US Dollar (USD) on Wednesday, dragging the price of EUR/USD to less than 1.0600 ahead of the Germany’s unemployment and manufacturing news releases. The technical bias remains bearish because of a lower high in the recent upside rally.

Germany Unemployment & Manufacturing Data

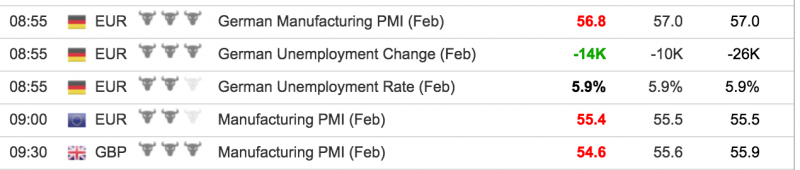

The Bundesagentur für Arbeit of Germany was scheduled to release the unemployment figure today. According to the average forecast of different economists, the unemployment in Germany registered a 10k decline during the month of February as compared to 26k decline in the month before. Markit Economics also released the Germany’s Manufacturing Purchasing Managers Index (PMI) data today. According to the median projections of economists, the PMI registered a 57 points gain in February as compared to the same reading in January 2017.

The results are close to the forecasts, but PMI’s are in the red zone, however, Unemployment Rate improving it’s positions compare to the previous period:

How EUR/USD Reacted to Unemployment Data in Past?

EUR/USD rallied sharply after the release of unemployment data in January because the actual figure came out -26k as compared to the market expectations of just 5k decline, up beating the average projections of economists by a long shot.

The pair however did not show any noticeable move after the Germany’s unemployment data in December 2016 because the actual figure came out in line with the market expectations. The actual reading was -5k as compared to the same forecast.

How to Trade today’s Unemployment Data?

Positive Unemployment Rate report “conflicts” with negative PMI data. Now we can see strong resistance level around 1,0547:

On the other timeline we can detect strong downtrend:

So it is more likely for this downtrend to continue, as the European PMI’s and Unemployment Rates reports have opposite impact on euro.