EURUSD – (October 12, 18:00 GMT) FOMC Meeting Minutes.

Last Friday US labor market data was published and it was insignificantly lower than the forecast. Level of unemployment increased by 0.1% from 4.9% to 5.0% while the NonFarm result was 156,000 against forecasted 175,000.

Despite the fact that the level of unemployment remains significantly lower that 6% (optimal value) it keeps increasing (in June the level of unemployment was 4.7%) and market participants start to worry about the future of US labor market.

Now traders emphasize the FOMC Meeting Minutes report as most likely some information and vision regarding the future of US economy will be described there. If market participants won’t find the ways how to solve all the issues in US economy then there will be a high chance that the refinance rate will remain on the same level and that is why USD might be under pressure.

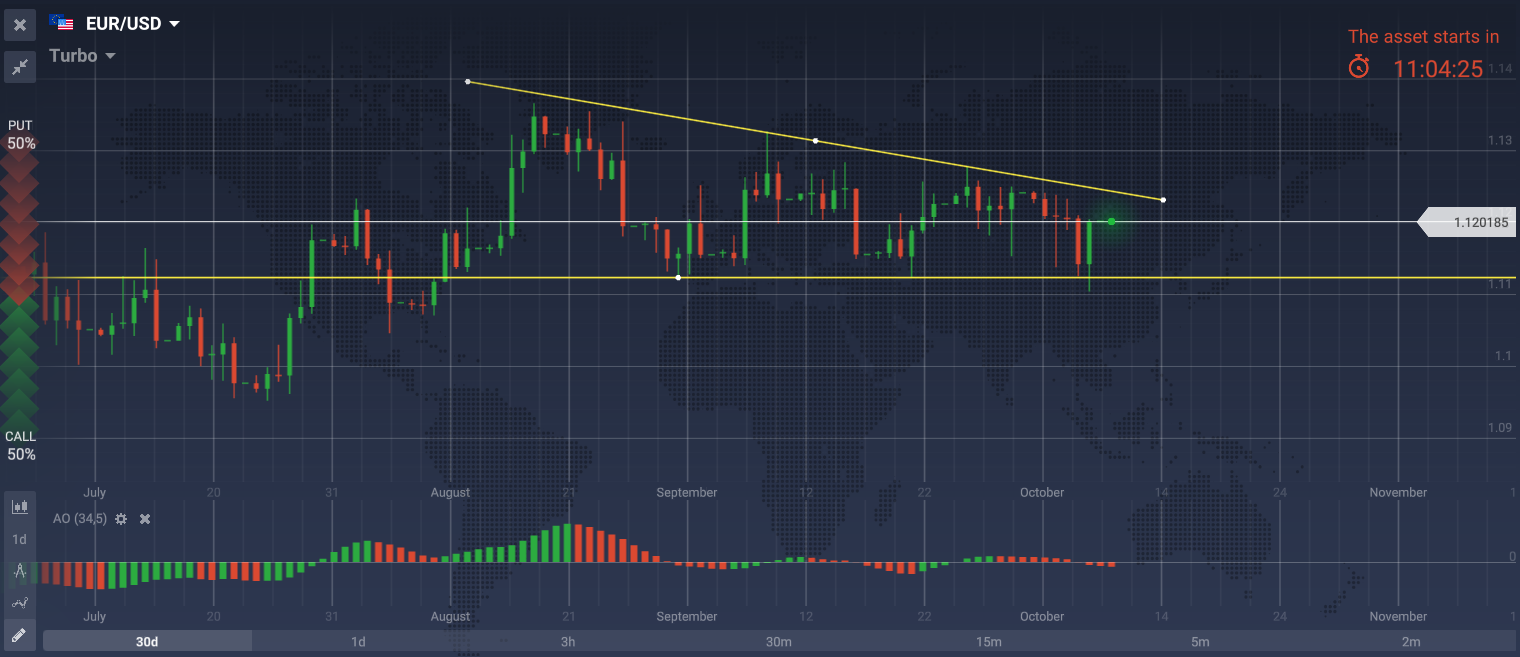

EURUSD chart

There is still a flat rate movement on EURUSD D1 chart and the rate is moving in the narrowing price range (highlighted with yellow on the price chart). According to the indicator of technical analysis “Awesome Oscillator” the possibility of downward rate movement prevail. Also, the factors of fundamental analysis point at the same scenario.