GBPUSD – October 13, 11:00 GMT.Bank of England MPC Announcement and interest rate decision.

ast week there was a strange situation in the Asian stock exchange, during which British pound temporarily went down more than 1000 points. it caused another panic on the market, despite the fact that most of the positions were recovered. Many market’s participants put in question Where is the «bottom” of GBP/USD and to which point it is going to fall down?

Unfortunately, institutional trader do not like the moments of volatility and some of them started to close the positions on the British pounds, which also has a negative impact on the national currency of the Great Britain. Moreover, economic data remains weak and it also has a negative impact on GBP.

BoE MPC Announcement and Interest Rate Decision will be the next thing to consider for many traders and if the leaders of Bank of England decide to cut it, it will have a massive negative impact on GBP as well.

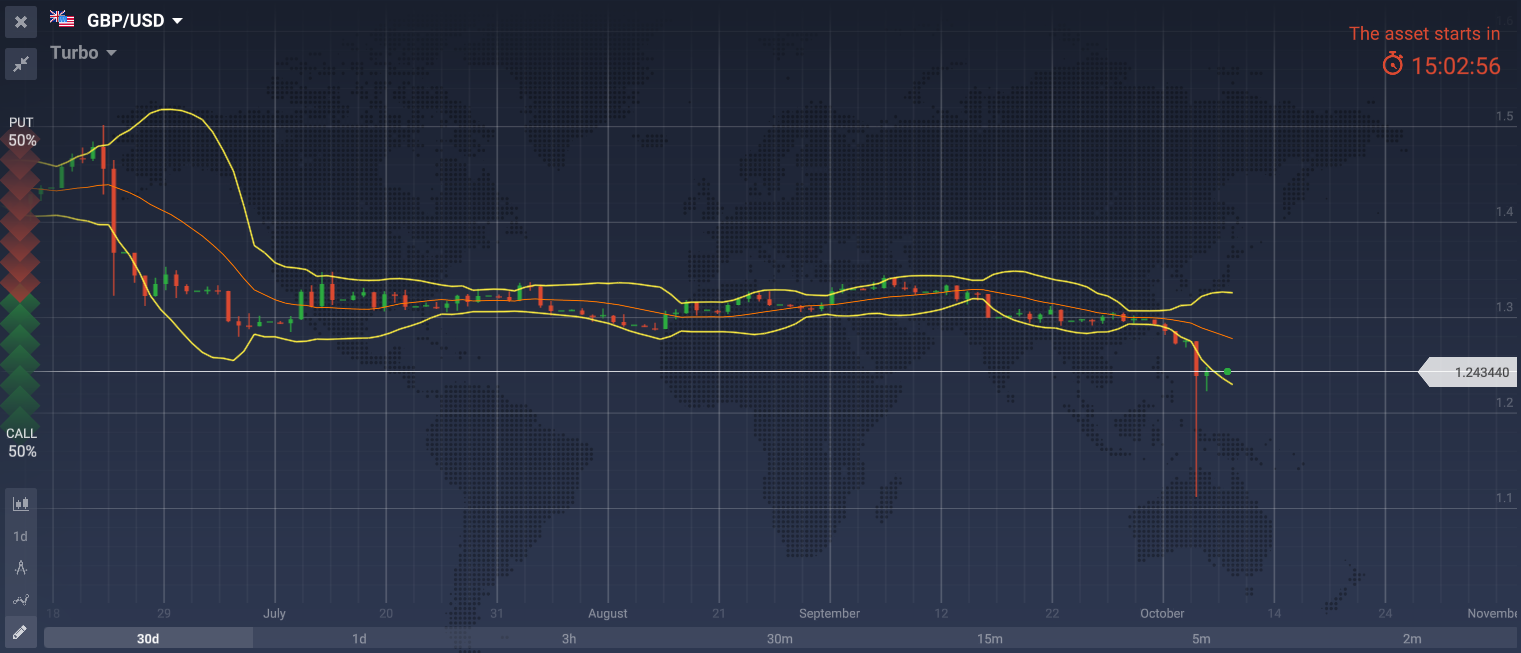

GBPUSD chart:

After the “Brexit” referendum (citizens of United Kingdom decided to leave European Union) the value of British Pound started to decrease rapidly. On GBPUSD D1 chart the rate decreased from 1.5 to 1.24344 since June 24th, 2016 and that it far from the end.

What is more, after the latest events the rate broke the bottom line of Bollinger Bands indicator and now a short upward price correction is expected, but the global trend is still bearish.