Is the Euro Move For Real?

The euro dropped 8% in the two months following Donald Trump’s surprise victory. Investors were optimistic that he would pass his campaign promises of tax cuts and infrastructure spending given the Republican Congress and Trump’s popularity within the Republican party. They poured into the dollar and US stocks in anticipation of an acceleration in growth.

The euro has clawed back half of these losses as significant legislation has failed to materialize, and US economic figures have disappointed with first quarter GDP downgraded from 3% to 0.5% over the last three months. Other misses have included a continuous decline in retail sales, an underwhelming jobs report, and weaker than expected inflation.

This will result in a more cautious Fed which translates to lower interest rates and a weaker dollar. In contrast, Europe is outperforming expectations with 0.7% GDP growth compared to expectations of 0.4%. Additionally, inflation figures, employment numbers, and manufacturing has surprised on the upside. Of course, the US is dealing with high expectations while Europe has very low expectations.

Trade Setup

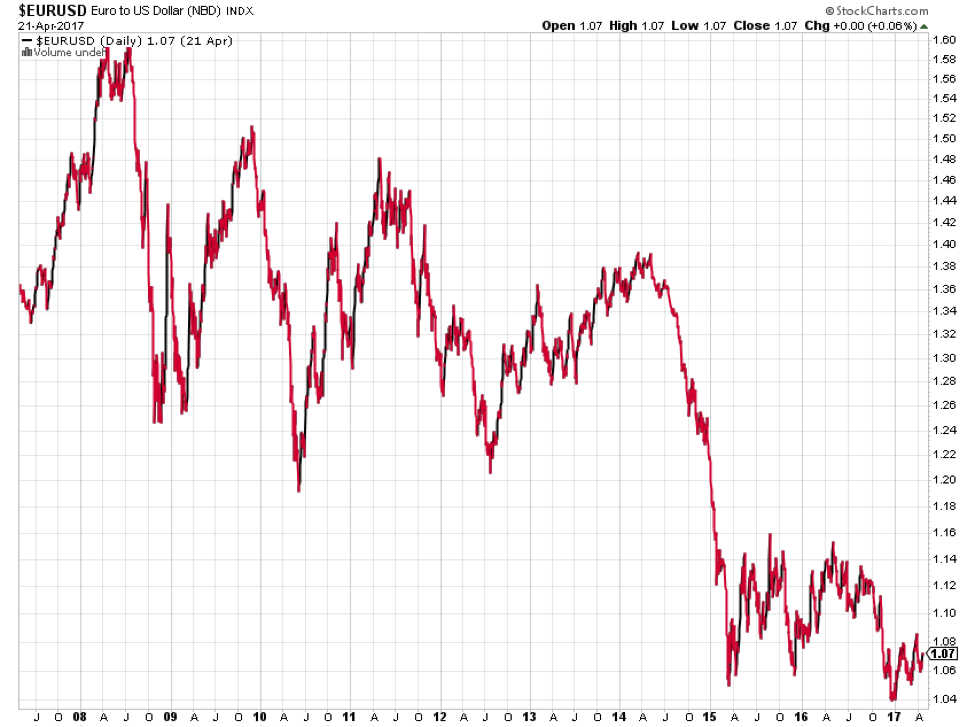

The euro has trended lower since 2008 and conditioned traders to continue selling the rips. This can be seen in sentiment readings which show extreme bearish sentiment towards the euro despite the recent move higher. Getting long the euro is a contrarian trade with a definite downside and significant upside.

Most of traders prefer to stay bullish on the euro at current levels with a price target of 1.15 and a stop loss at 1.03.