The US Dollar (USD) inched higher against the Japanese Yen (JPY)

The US Dollar (USD) inched higher against the Japanese Yen (JPY) on Wednesday, increasing the price of USDJPY to more than 114.25 ahead of several high profile fundamental events. The technical bias remains bullish as the price continues trading in an upward slope channel.

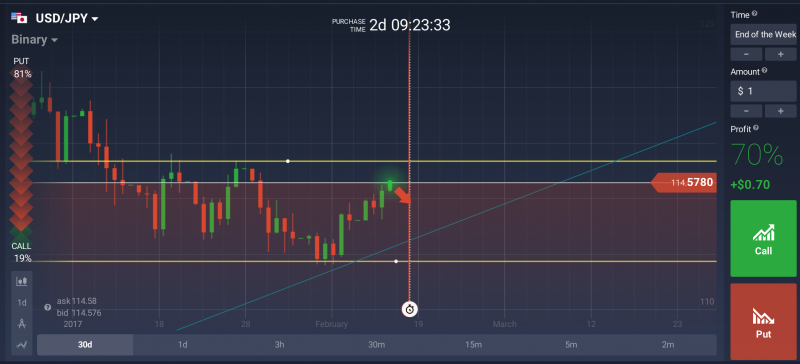

Technical Analysis

As of this writing, the pair is being traded around 114.36. A hurdle may be noted near 114.48, the immediate trendline resistance area ahead of 115.37, the high of January 27th, 2017 as demonstrated in the given below chart. A break and four-hour closing above the 115.37 resistance shall incite increased buying pressure, validating a rally towards the 117.00 resistance zone in short to medium term.

On the downside, the pair is likely to find a support around 114.00, the psychological number as well as trendline support ahead of 113.46, the 50% fib level and then 111.59, the low of 6th February 2017. The technical bias shall remain bullish as long as the 111.59 support area is intact.

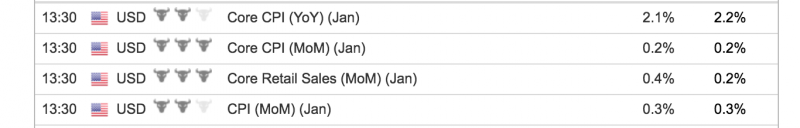

CPI report – Today at 13:30 GMT

The US Bureau of Labor Statistics is due to release the Consumer Price Index report today. The report is considered a key gauge for inflation. According to the average forecast of different economists, the CPI remained 2.5% in January as compared to 2.1% in the same month of 2016. Generally speaking, higher CPI figure is considered positive for the US Dollar and vice versa.

Retail Sales

The Census Bureau of the US is also due to release the retail sales data today. According to the average forecast of different economists, retail sales registered a gain of 0.1% in January as compared to 0.6% in the month before. Generally speaking, higher retail sales figure is considered good for the US economy and vice versa.

How to Trade USD/JPY amid US Economic Releases

- The price of USD/JPY is expected to test 115.30 and 117.00 resistance levels in short to medium term if the CPI data comes better than expectations.

The CPI release is extremely important as the Federal Reserve’s interest rate decision heavily relies on CPI and unemployment figures.

- If the CPI misses average projections, then we can expect at least 200-300 pips fall in the USD/JPY price by the end of this week.