UR/USD Options (CPI News Release)

The Euro (EUR) inched lower against the US Dollar (USD) on Wednesday, dragging the price of EUR/USD to less than 1.0600 ahead of the Eurozone Consumer Price Index (CPI) news release. The technical bias remains bearish because of a lower high in the recent upside rally.

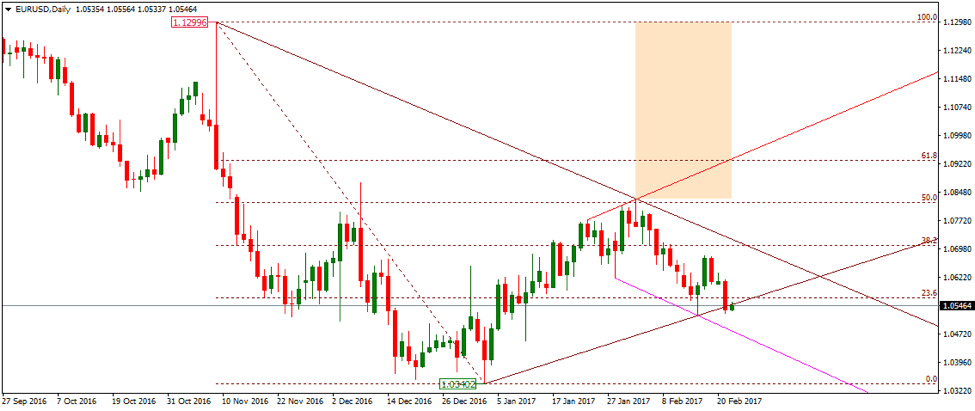

Technical Analysis

As of this writing, the pair is being traded around 1.0543. A support may be seen near 1.0484, the trendline support area as demonstrated in the given below daily chart with pink color. A break and daily closing below the 1.0484 trendline support shall incite renewed selling interest, validating a move towards the 1.0400 support zone which is a psychological number.

On the upside, the pair is expected to face a hurdle near 1.0552, the trendline resistance area ahead of 1.0700, the cluster of many resistance levels such as 38.2% fib level, upper trendline as well as psychological number. The technical bias shall remain bearish as long as the 1.0828 resistance zone is intact.

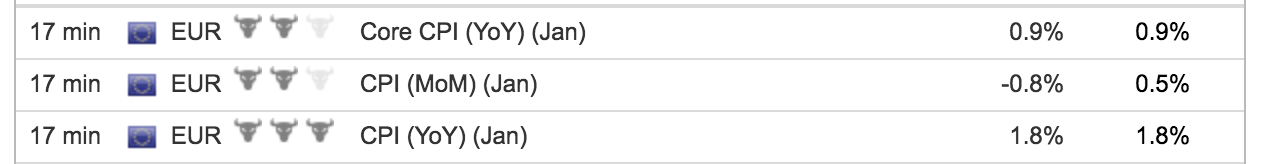

Eurozone Consumer Price Index

Eurostat is due to release the Consumer Price Index (CPI) data on Wednesday. It is considered to be a key gauge for inflation. According to the average forecast of different economists, the CPI remained 1.8% in January as compared to the same reading in January 2016. Generally speaking, higher CPI is considered good for the economy and vice versa.

How EUR/USD Reacted to Past CPI Releases?

Last time when CPI data was released by the EuroStat, the actual reading came out to be 1.8% as compared to the forecast of 1.3%, up beating the average forecast of economists. As per expectations, the Euro rallied 60 pips soon after the release.

In December, the actual data came out to be 1.1% as compared to 1.1% forecast of economists, hence meeting the average projection of economists. The EUR/USD pair didn’t show any notable volatility after the December’s CPI release.

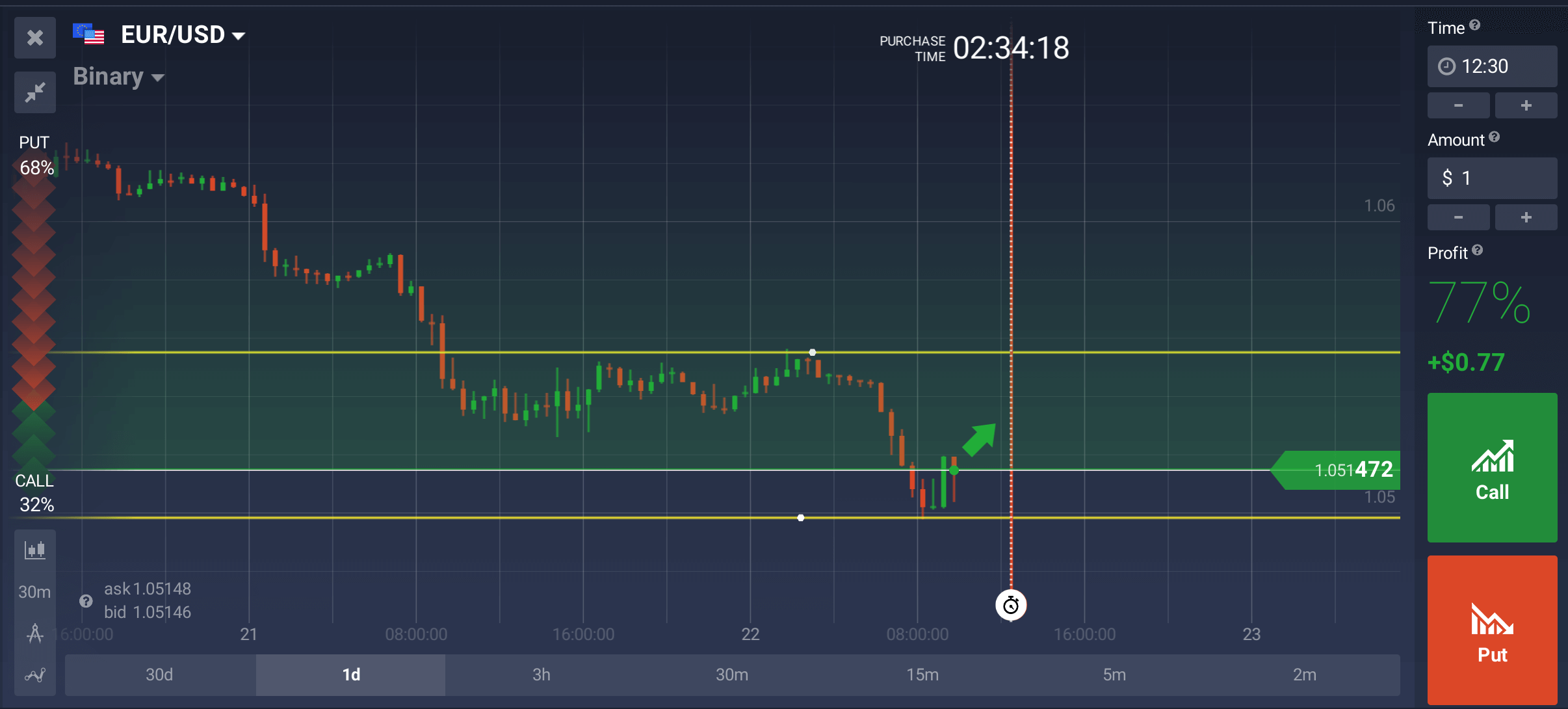

How to Trade today’s CPI Data?

- Today if the CPI data comes more than 1.8%, then buying call options near resistance zone can be a good strategy.

- Alternatively, if the actual figure remains less than 1.8%, then buying put options below the trendline support can be a good strategy.