USD/JPY – US ADP Employment Change news.

The US Dollar (USD) extended downside movement against the Japanese Yen (JPY) on Wednesday, dragging the price of USD/JPY to less than 113.75 ahead of the US ADP Employment Change news. The technical bias remains bullish because of a higher low in the recent downside move.

Technical Analysis

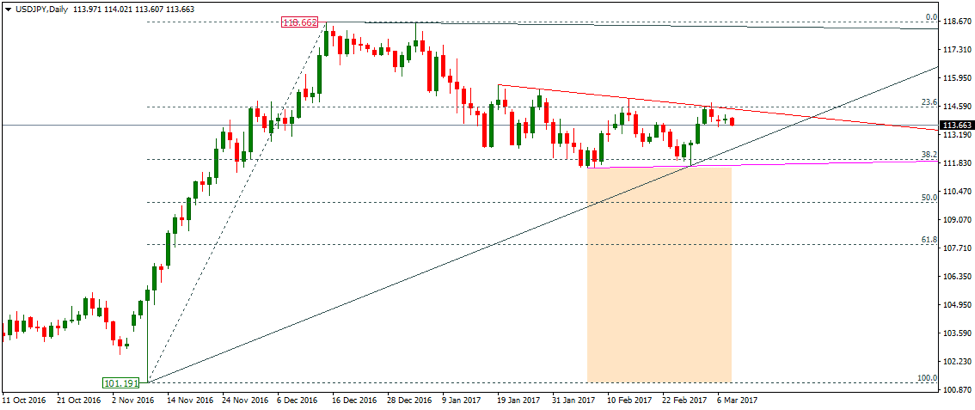

As of this writing, the pair is being traded around 113.65. A support may be seen near 112.51, the trendline support area ahead of 112.00, the psychological number and then 109.97, the downward trendline as demonstrated in the given below daily chart with pink color. A break and daily closing below the 109.97 support shall incite renewed selling pressure, validating a move towards 109.50 and then 109.20.

On the upside, the pair is expected to face a hurdle near 114.46, the trendline resistance area ahead of 115.00, the psychological number and then 118.61, the high of January 3rd, 2017. The technical bias shall remain bullish as long as the 112.18 support area is intact.

US ADP Employment Change

The Automatic Data Processing Inc. of the US is due to release the employment change figure today during the US trading session. According to the average forecast of different economists, 190k new jobs were created in February as compared 246k jobs in the month before.

The Employment Change released by the Automatic Data Processing, Inc, Inc is a measure of the change in the number of employed people in the US. Generally speaking, a rise in this indicator has positive implications for consumer spending, stimulating economic growth. So a high reading is traditionally seen as positive, or bullish for the USD, while a low reading is seen as negative, or bearish.

How USD/JPY Reacted to Past Factory Orders Releases?

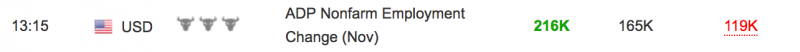

USD/JPY inched higher by more than 50 pips after the release of last ADP employment change data. According to the last ADP report, 216k new jobs were created, upbeating the average forecast of 165k jobs.

The pair also rallied after the release of December’s employment change report. The actual outcome was 216k as compared to the forecast of 165k.

How to Trade today’s Factory Orders Report?

Buying the USD/JPY call options near above mentioned support levels can be a good strategy if the ADP Employment Change data comes below the projections of economists.

Similarly, buying the USD/JPY put options near the above mentioned resistance levels can be a good move if the actual outcome remains better than the forecast.