Eurodollar Crashes

The ECB has just released the statement for the October policy decision. The decision was as expected, no change to interest rates. What wasn’t expected was a dovish tone to the statement and an extension of QE. The bank has decided to decrease the amount of monthly bond purchases starting January of 2018. The decision will cut bond purchases by 50% to 30 billion Euros and extend the taper of quantitative easing into the 4th quarter of next year and possibly further.

The reason for the cut is lackluster inflation data. Although economic data suggests that growth is present and expanding it remains tepid with inflation running below the target 2% rate. The bank expects the target to be hit next year but has also pushed out their expectations for that event. Traders had not been expecting a change in policy or even for the bank to increase bond purchases, they were however expecting a hawkish tone to the meeting and that is far from what they got.

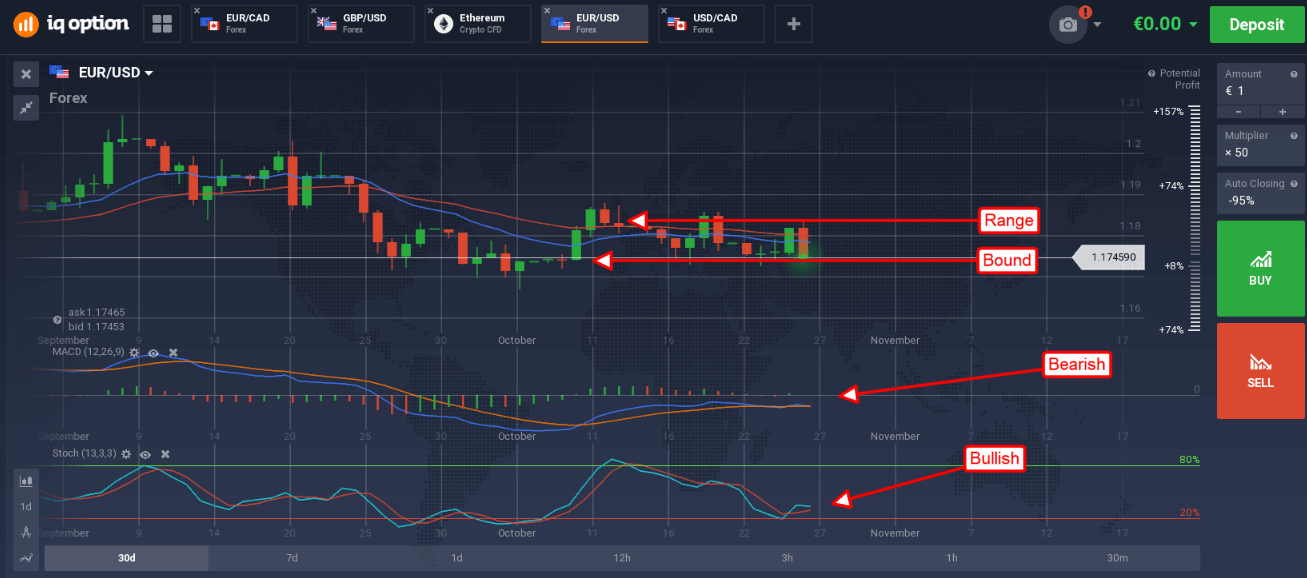

The EUR/USD fell hard on the news, shedding more than 100 pips within minutes of the release. Selling pressure took the pair down to support targets near 1.1740 but has left it range bound in the near and short term. The indicators remain mixed, consistent with a range bound market, and suggest that sideways trading could continue over the next few days. Tomorrow’s US GDP data could be the spark to break the pair out of this range but likely not as the FOMC meeting is just next week.

Support appears to be firming near 1.1740/1.1750 but this level may break on strong US GDP. If so next target for support is 1.1700 and a 1 month low. A break below that level would be bearish. If support holds and/or a bounce ensues upper targets are 1.1820 and then 1.1880. GDP is expected to slow from the 2nd quarters 3.1% to 2.8% in the 3rd. Regardless of decline, 2.8% is above the 2% annualized 2017 target and would help support if not strengthen forward FOMC rate hike expectations. At this time there is little expectation for a hike next week but they could get hawkish in the statement.

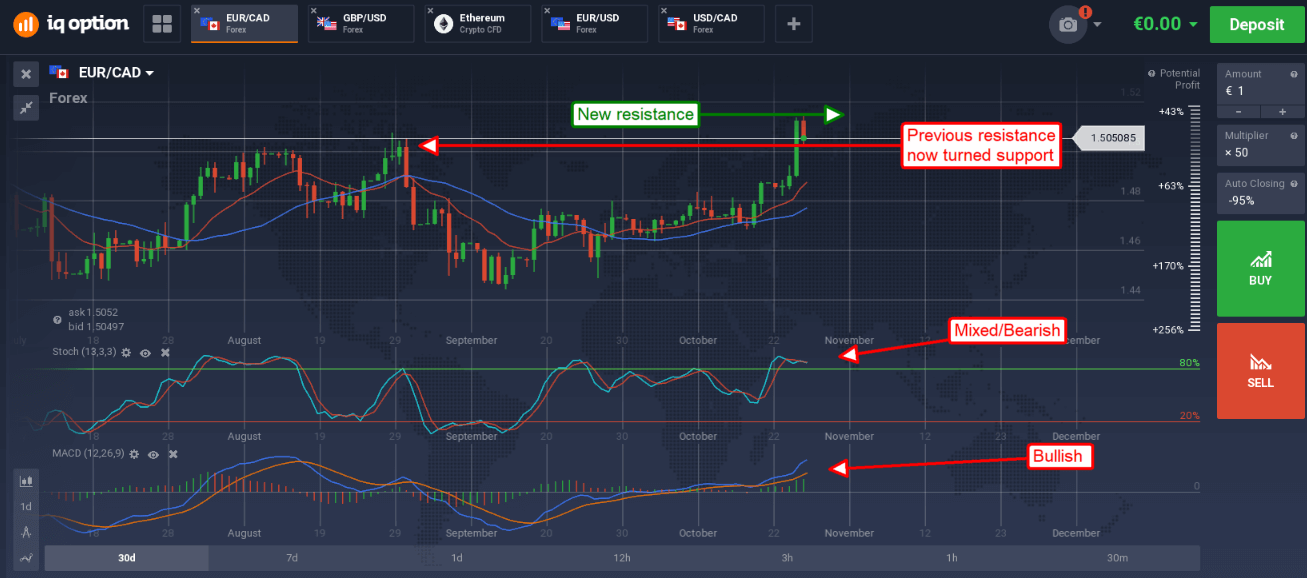

The EUR/CAD reversed in mid session to confirm resistance near 1.5140. This level was hit following a strong move higher and break of resistance at 1.5025 sparked yesterday with the Bank of Canada decision. Their decision was slightly more dovish than expected and caused the CAD to weaken substantially within its range. Today’s move was similar in tone, weakened the EUR and brought the two currencies back into balance.

The pair is now testing resistance/turned support at 1.5025 and may move lower. The indicators are mixed, MACD is peaking and strong while stochastic is moving lower, but consistent with uptrend in the short term. A break of support targets could take the pair down to 1.4900 or lower. A bounce would confirm support and up trend with targets near 1.5230. Regardless, the pair is likely to remain range bound in the long term.